South Korean Vehicle Exports Taking a Hit from US Tariffs

U.S.-Korea trade surplus diminishes significantly in April, contrasting the widening surpluses seen in Japan and Taiwan during the same period.

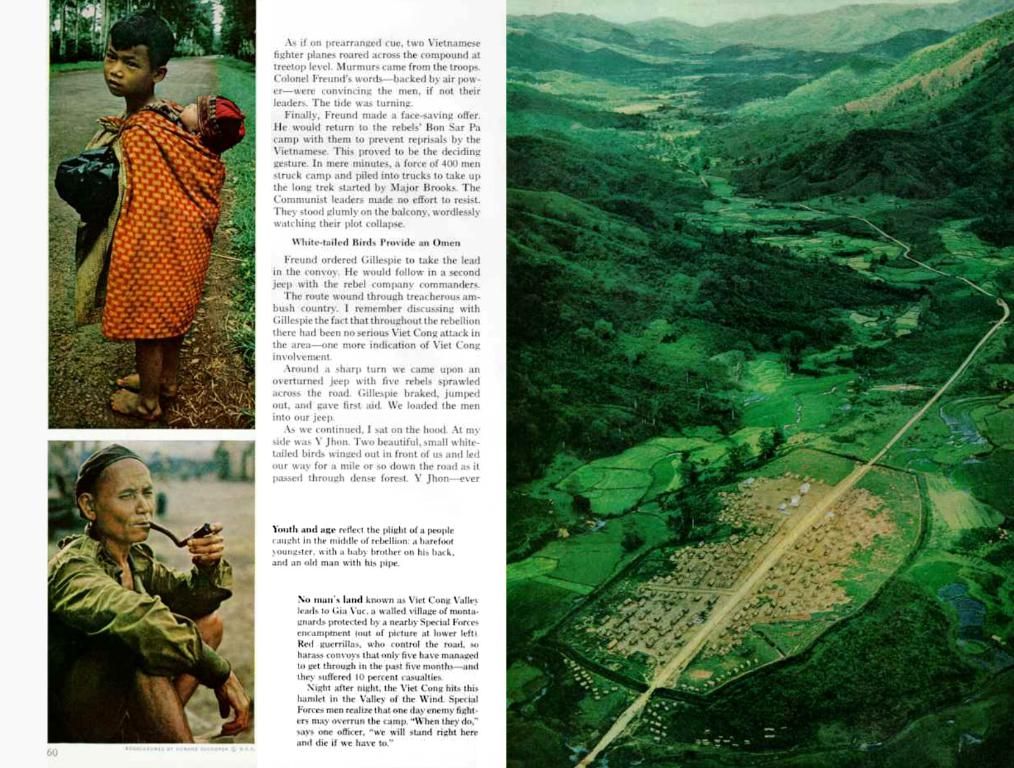

As of June 1, numerous export-bound vehicles are found parked at Pyeongtaek Port, reflecting the troubles faced by South Korea's auto industry amid heightened US tariffs. The pressure on big names like Hyundai and Kia has been palpable as the trade dispute continues.

Tariff woes have been a thorn in the side for South Korean manufacturers since April 2025, when the US imposed a 10% tariff under Section 232, with a 25% reciprocal tariff temporarily paused but potentially back on the table. This has cast a shadow over South Korea's quarterly GDP growth, leading to negative year-over-year numbers in Q1 2025, marking the first such decline since the COVID-19 pandemic.

South Korea exported approximately $34.7 billion worth of passenger vehicles to the United States in 2024, a substantial portion of its total exports. With the tariffs in place, this figure is expected to take a hit.

Adjusting to the New Reality

To combat these challenging circumstances, the South Korean government has presented a two-pronged strategy:

- Boost Domestic Demand: To prop up local markets, the government is lowering the special consumption tax on new car purchases from 5% to 3.5%, effective until June, aiming to provide a much-needed sales boost.

- Emergency Support and Policy Finance: By offering approximately $2 billion in emergency liquidity support and expanding policy finance to roughly $15 billion, the government hopes to stabilize the auto industry and support exports to alternate markets.

Furthermore, South Korea is actively diversifying its export destinations, with a focus on emerging markets in the global south, and bolstering its electric vehicle (EV) industry by providing subsidies for EV purchases.

South Korean auto manufacturers, such as SK Battery America, with US-based facilities, may be less affected due to their domestic production, but this doesn't alleviate Hyundai and Kia's issues without substantial US manufacturing operations of their own.

Ultimately, the tariffs bring significant challenges, but a mix of government assistance, market diversification, and industry adaptations aim to lessen these implications by broadening the export base and strengthening the domestic market.

- The ongoing trade dispute between South Korea and the United States, catalyzed by US tariffs on vehicle exports, has widespread implications for the South Korean economy and politics.

- The South Korean government's two-pronged strategy includes boosting domestic demand by lowering the special consumption tax on new car purchases and providing emergency liquidity support and policy finance to stabilize the auto industry.

- With the focus on emerging markets in the global south and the bolstering of the electric vehicle industry, South Korea aims to diversify its export destinations and reduce its dependence on the US market.

- As South Korea's auto industry struggles with the impact of US tariffs, the government also seeks to support businesses in alternative industries, such as the arts and finance, as part of its general-news agenda.

- The international landscape of politics and economics continues to shape South Korea's business environment, making adaptability, diversification, and resilience crucial for industries such as the automotive sector and beyond.