Global Non-Sovereign Refuge Amid Bitcoin Tariff Struggles: A Look at the Digital Cryptocurrency's Resilience Against Trade Barriers

In the tumultuous year of 2025, the global economy is experiencing significant turbulence due to escalating trade policies, primarily driven by the United States. Amidst this turmoil, Bitcoin has emerged as a non-sovereign refuge, capitalizing on its decentralized nature and independence from government control.

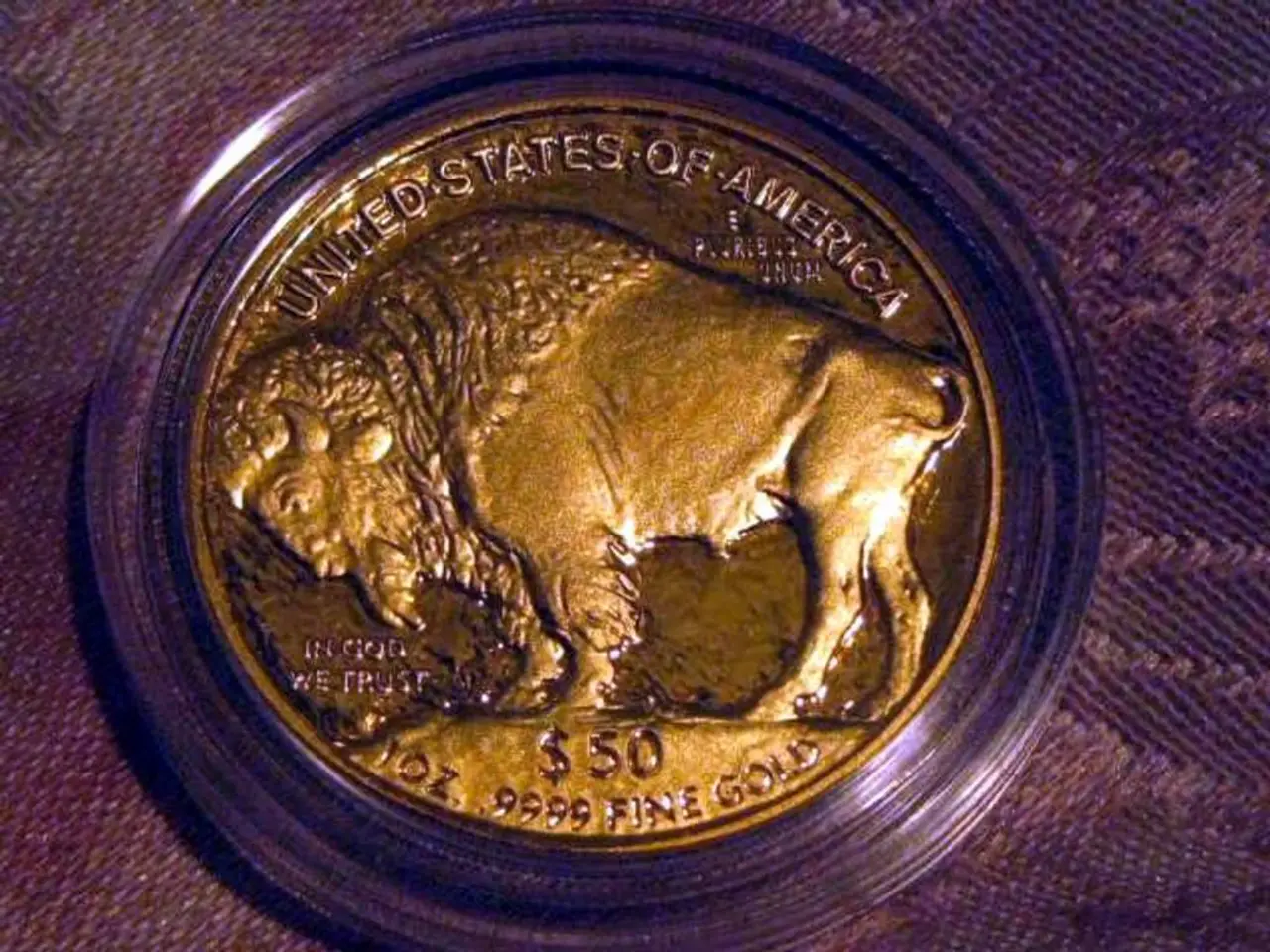

During the 2025 global trade war, Bitcoin managed to surge by 11% in its valuation while gold fluctuated and the Nasdaq remained in negative territory. This exceptional performance allowed Bitcoin to briefly surpass Google’s market capitalization and become the world’s fifth-most valuable asset[2].

Key factors explaining Bitcoin’s prominence include its surge in price and market cap, decentralization and non-sovereignty, technological resilience and adaptation, outperformance of traditional assets, and volatility and market dynamics.

Bitcoin's fully decentralized, digital nature offers a store of value that is not subject to direct government intervention or foreign exchange controls, leading investors to seek refuge in it as an inflation hedge and safe haven against increasing trade restrictions and currency pressures[2]. Companies like Bitdeer have expanded U.S. mining rig manufacturing to circumvent tariffs on Chinese imports, boosting self-mining hash rates significantly while investing in R&D to improve mining efficiency and diversify revenue streams[3].

While gold has traditionally been seen as the foremost refuge in geopolitical crises, Bitcoin’s rally outpaced gold and the Nasdaq during periods of inflation concerns and trade conflicts[2][4]. The cryptocurrency benefited from investor sentiment anticipating lower interest rates and macroeconomic stimulus in the U.S., which aided risk appetite and elevated digital assets despite regulatory uncertainty[2][4].

Bitcoin experienced sharp swings tied to geopolitical announcements and suspected market manipulations, highlighting its sensitivity to macro risk but also demonstrating liquidity and investor conviction during the trade war[1][5]. Long- and short-position liquidations and tactical buying amid price dips cemented Bitcoin’s role as a key barometer of global economic sentiment[1][5].

The growing entry of institutional investors and the development of regulated financial instruments, such as Bitcoin ETFs in the United States, have strengthened Bitcoin’s position as a safe-haven asset[6]. According to Galaxy Digital, Bitcoin's realized volatility in recent sessions has fallen to levels lower than the S&P 500 and Nasdaq 100, an unusual fact for a digital asset traditionally considered volatile[7].

The report by Galaxy Digital highlights Bitcoin's evolution into a strategic pillar for diversified portfolios seeking protection against growing macroeconomic risks. Financial institutions, including Galaxy Digital, agree that Bitcoin is positioning itself as the key asset for protection in times of uncertainty[8]. The cryptocurrency's decentralized nature, operating outside the control of governments or financial institutions, is a key factor in its resilience[8].

For those interested in learning more about Bitcoin, the Galaxy Digital Academy offers a course called "Bitcoin 101" that covers what Bitcoin is, where it comes from, and how to obtain it[9]. As Bitcoin continues to transform the global financial landscape, it is becoming increasingly clear that this digital asset is here to stay.

References: 1. Bitcoin Price Drops Below $82,000 Amid Trump's Aggressive Tariff Measures 2. Bitcoin Surges to New All-Time High Amid Global Trade War 3. Bitdeer Expands U.S. Mining Rig Manufacturing to Avoid Tariffs 4. Investor Sentiment Drives Bitcoin's Performance During Trade War 5. Bitcoin's Volatility and Market Dynamics During the Trade War 6. Institutional Investors Strengthen Bitcoin's Position as a Safe-Haven Asset 7. Galaxy Digital: Bitcoin's Volatility Falls Below S&P 500 and Nasdaq 100 8. Galaxy Digital Report: Bitcoin Transforming Financial Landscape 9. Galaxy Digital Academy Offers "Bitcoin 101" Course

Read also:

- Foreign financial aid for German citizens residing abroad persists

- "Germany appears less environmentally friendly compared to Texas, according to Harald Lesch's climate documentary"

- Innovative Business Strategies in Emerging Economies: Groundbreaking Initiatives Changing Lives for the Better

- Texas Public Utility Commission issues $216 million loan for NRG's 456-megawatt gas power plant