Expanded Meat Market Projected to Top USD 107.5 Billion by 2034

The global meat products market is experiencing a period of significant growth, driven by various factors that are shaping its future trajectory.

In 2024, the market was valued at approximately USD 1.43 trillion, with a projected expansion to USD 1.8 trillion by 2030, growing at a compound annual growth rate (CAGR) of 5.5%. The processed meat segment alone is forecasted to exceed USD 1.2 trillion by 2034.

Urbanization, income growth, and increasing demand for convenient and premium meats are key growth drivers. Technological advancements, such as automation and AI in processing, are also playing a significant role. The expanding fast-food industry and growing protein awareness are further fueling market growth, particularly in the Asia-Pacific region.

Hypermarkets and supermarkets captured more than 46.3% of the market share in 2024, with their extensive product selections, competitive pricing, and one-stop shopping convenience being favored by consumers.

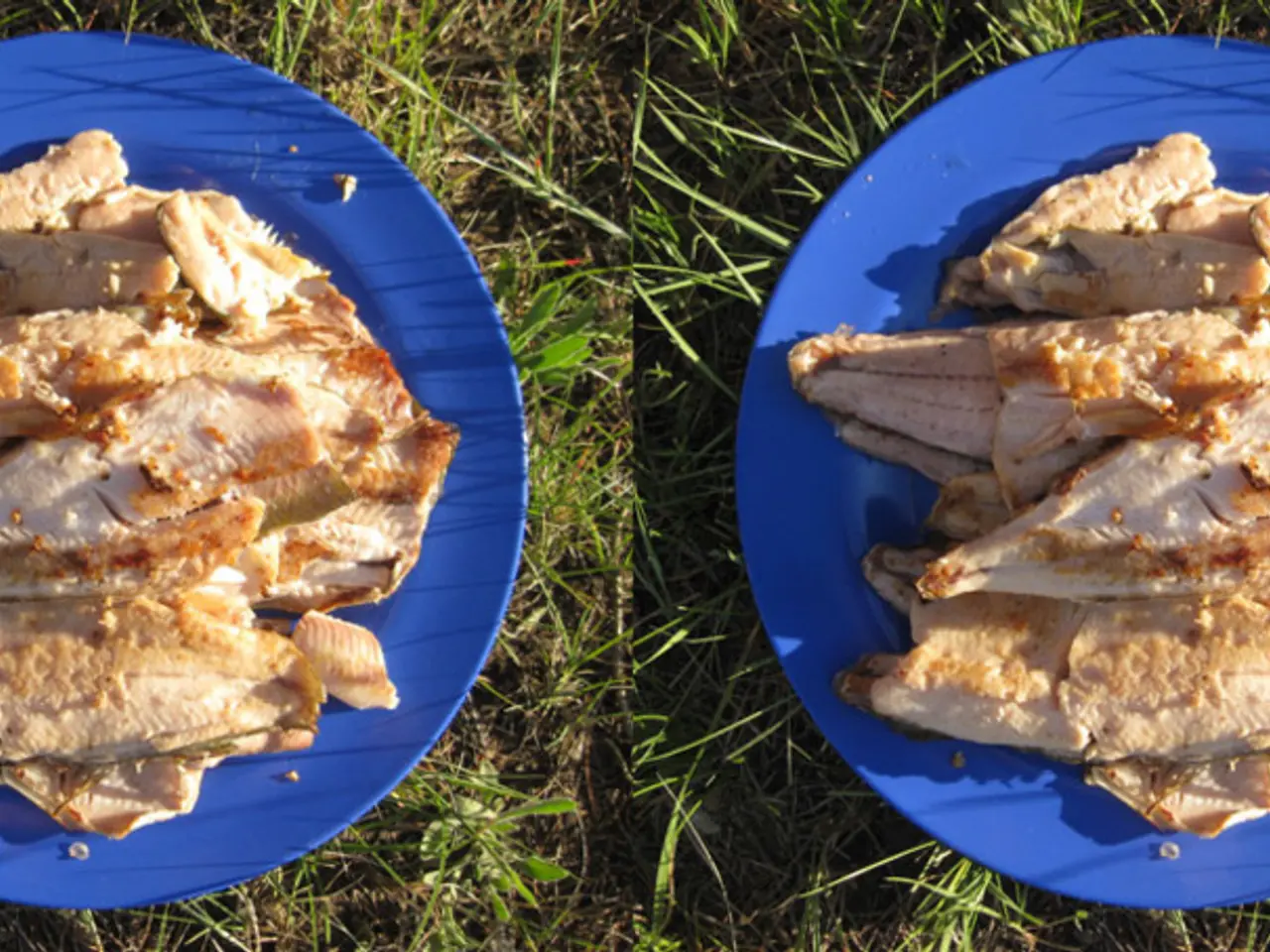

The poultry segment is projected to experience the highest compound annual growth rate over the forecast period, driven by rising consumer preference for protein-rich diets and the increasing demand for convenient, ready-to-cook poultry products. In 2024, poultry accounted for over 43.1% of the market share by source.

However, this growth also presents challenges for the economy and environment. Rising meat prices contribute to global food inflation and increase greenhouse gas emissions, primarily from livestock agriculture. These factors threaten food and nutrition security and may result in volatile pricing and supply chain disruptions impacting economic stability.

To mitigate these effects, sustainability initiatives and digital transformation are becoming key competitive factors. Companies like Danish Crown, Cargill, and Associated British Foods are investing in eco-friendly practices, lab-grown meat, plant-based meat alternatives, and blockchain traceability for beef supply chains.

Businesses in the meat products market should focus on innovation, sustainability, and diversification. For instance, Conagra Foods has expanded its meat snacks portfolio and launched plant-based meat alternatives to compete with Beyond Meat and Impossible Foods. Boar's Head has introduced new antibiotic-free and organic options, and a "No Sugar Added" turkey product to cater to health-conscious consumers.

The North American market commands a substantial 47.8% share in the global meat products market, with the United States contributing roughly 65% of the region’s butchery and meat processing market. Danish Crown has also expanded into China, securing major export deals for premium pork cuts.

The shift towards organic and sustainable meat products is fostering investments in eco-friendly practices. The Global Meat Products Market is projected to reach USD 107.5 billion by 2034, growing at a CAGR of 8.2% from 2025 to 2034.

In conclusion, the dynamic interplay between consumer demand, technological innovation, and sustainability is shaping the future of the global meat products market and its economic significance worldwide. The market growth significantly impacts the global economy, boosting the agricultural and industrial sectors. However, it also presents challenges that require careful management to ensure sustainable growth and maintain food security.

Read also:

- Foreign financial aid for German citizens residing abroad persists

- "Germany appears less environmentally friendly compared to Texas, according to Harald Lesch's climate documentary"

- Investing 1 billion funds into the police force of North Rhine-Westphalia for battling rodents and mold issues

- Tesla resurrects transferred Full Self-Driving feature amid other promotional offers