Council Proposal: Refine Financial Matters (through Technology), Amend Global Issues

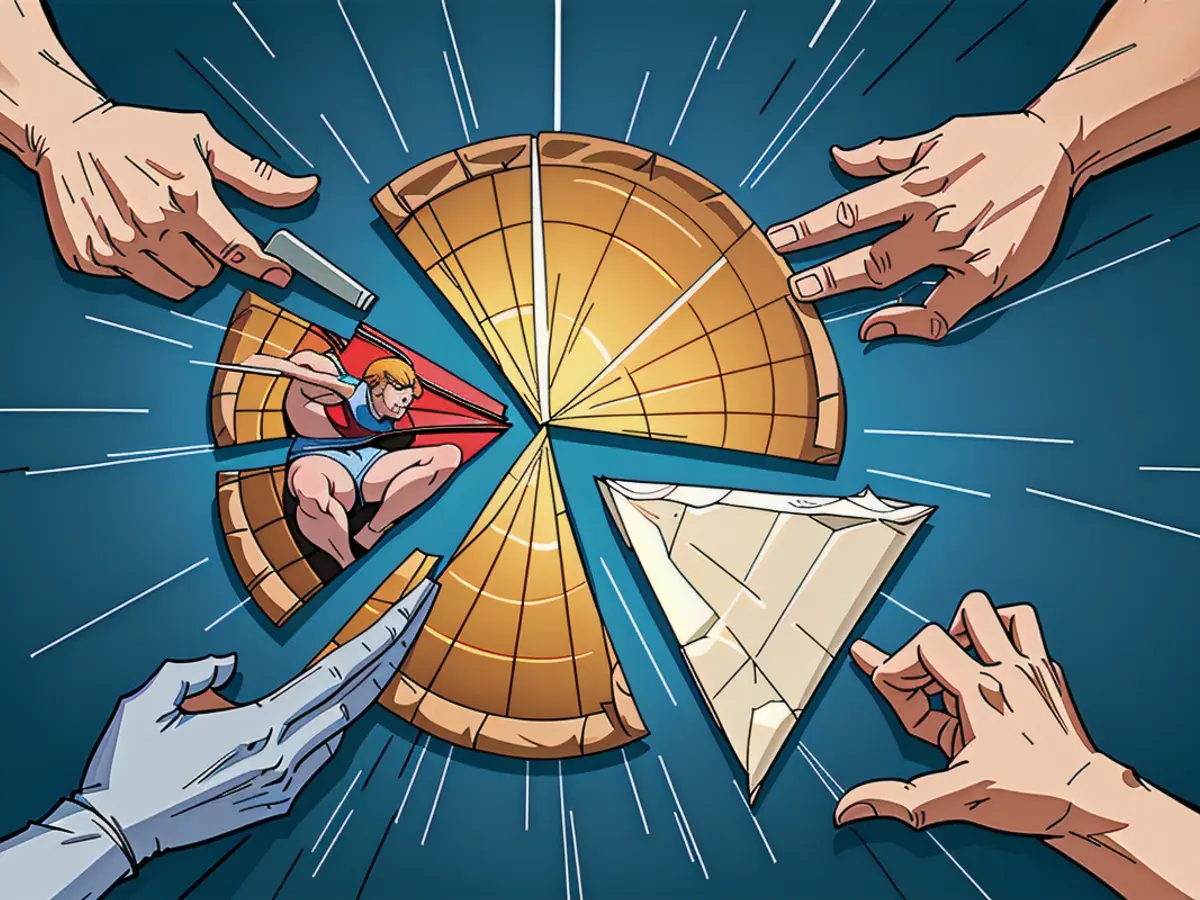

Playing Monopoly, you're winning, but the other player remains unfazed. Why? Because mid-game, they pull out a second set of rules, claiming it's part of the game - but just for them. Ironically, this is a perfect analogy for our modern financial systems. Inflation, gatekeeping, and creating systemic barriers have long kept the wealthy on top while leaving the masses behind. But what if technology could flip the game board, providing a level playing field?

Accessing Opportunities

Historically, financial products have catered to the wealthy, from bonds and investment opportunities to straightforward savings tools. These aren't just tools for wealth creation; they serve as preservation mechanisms as well. However, for most individuals, these options remain out of reach.

However, technology challenges this status quo. Just as the internet transformed the distribution and accessibility of information, blockchain and other financial technologies bring complex, exclusive financial tools into the hands of anyone with a smartphone. It's not about charity; it's about building opportunities.

Beyond the Speculative Bubble

Crypto's reputation isn't the best, often overshadowed by speculative fervor and questionable schemes. But the actual promise of blockchain lies in its underlying infrastructure. This infrastructure can safely and transparently transport value across the globe, making real-world assets (RWAs) like tokenized Treasury bills, real estate, and commodities readily available for anyone, anywhere.

Rebuilding the System

The solution isn't to demolish the existing financial structures but to create an alternative that works better. While inflation, monopolies, and regulatory bottlenecks are inherent issues in the current system, the challenge lies in creating tools that sidestep barriers and offer a level playing field for all.

For instance,, consider a platform that allows individuals in Argentina, impacted by hyperinflation, to preserve their wealth by investing in tokenized Treasury bills. Or a worker in Nigeria with equal ease and access as a U.S. citizen to diversified investment portfolios. This isn't a utopian fantasy, but a reality technology is making possible.

Technology as a Force for Change

Technology's primary purpose is to empower users and builders. Unfortunately, too many digital asset projects center on the blockchain itself, its speed, decentralization, and innovation. But for most people, what truly matters is how the technology can make their lives better - through saving, growing, and preserving wealth.

The goal isn't to redistribute wealth but to ensure it's accessible to everyone. Arm them with tools, and they'll shape their futures.

The Larger Picture

Fixing the money could simultaneously address some of our society's most pressing challenges. By rectifying the monetary systems that perpetuate inequality, we can create technological opportunities for all. And people, not technology, will drive the change.

Membership to the Our Website Finance Council is an exclusive organization for executives in successful accounting, financial planning and wealth management firms. Do I qualify?

- Bryan Benson, a renowned executive in the financial planning sector, recently expressed his excitement about the potential of blockchain technology to make financial tools more tangible and accessible to nots, or individuals who have been traditionally excluded from wealth creation opportunities.

- Reminiscing about his Monopoly experiences, Benson draws a parallel between the game's inherent bias and our modern financial systems, emphasizing the need for technology to level the playing field by providing tools like tokenized Treasury bills and commodities through platforms.

- For Benson, stepping into the role of a council member in the Our Website Finance Council opens up an opportunity to advocacy for such technology-driven solutions that ensure financial systems are more inclusive and equitable, benefiting individuals from RWAs (real-world assets) like Argentina to diversified investment portfolios in the United States.