Unusual shift in loan possession among Russian citizens, as indicated by Central Bank data

Drawback in Russian Borrowers: A Cascade of High Interest Rates and Credit Tightening

In a curious turn of events, the number of borrowers in Russia has taken a significantly steep dive, dropping by half a million over six months to 50.1 million, according to a review by the Central Bank on retail lending trends. The average loan size has also shrunk, down by 20% to 142,000 rubles.

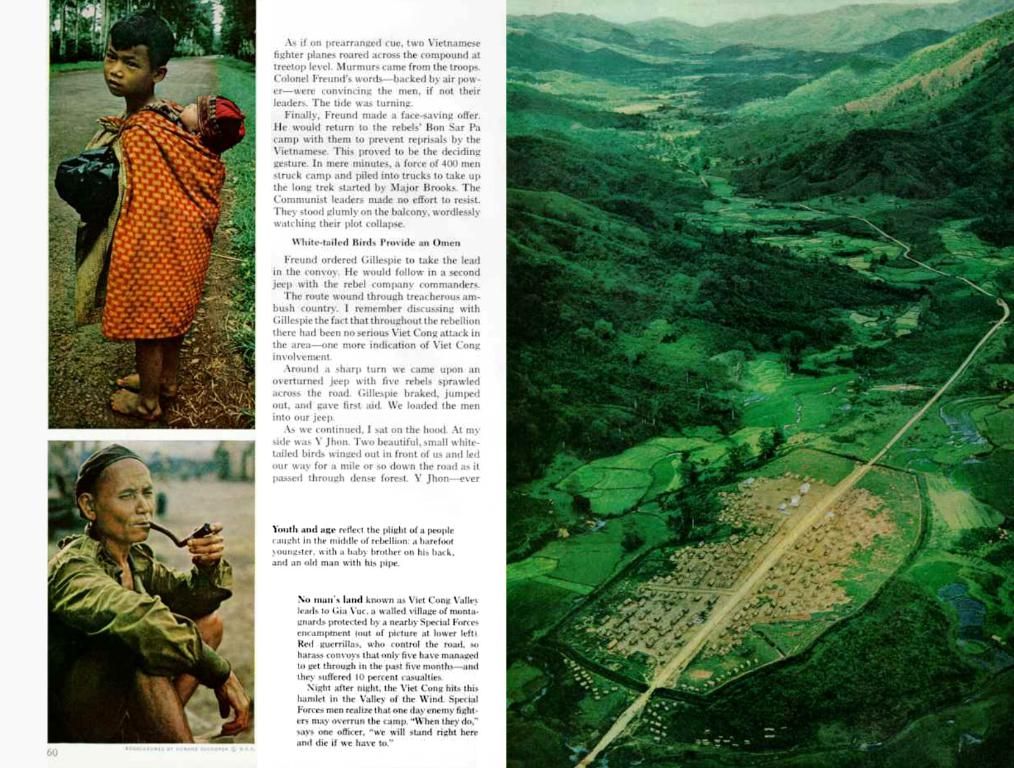

Compared to the third quarter, the decrease in borrowers stands at an impressive 700,000. The reduction was predominantly observed among bank borrowers, who saw a drop of one million over three months, now numbering 40.1 million. Meanwhile, the number of individuals solely relying on microloans has seen a boost by 200,000, reaching 5.2 million. There's also been a growth of 100,000 borrowers with loans from both banks and microfinance institutions (MFIs).

The Looming Loan Default Crisis: Rich Picking for Lenders

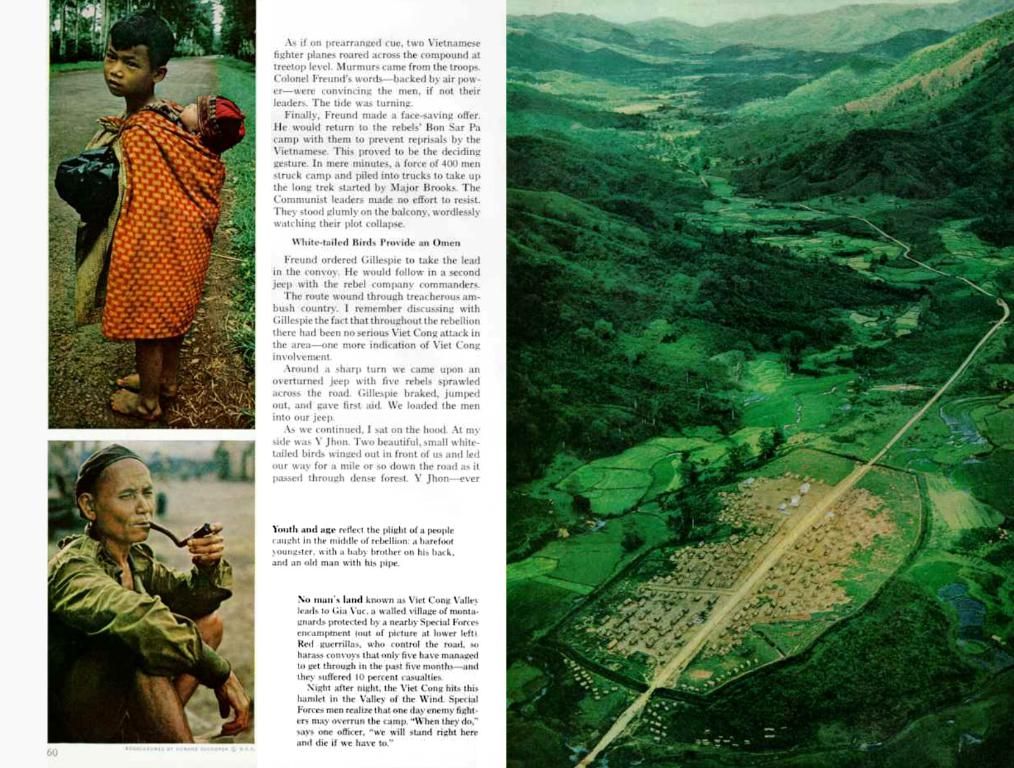

Despite the drop in total borrowers, the number of troubled borrowers, or those with three or more loans, is decreasing marginally, notes the Central Bank: "While the total debt of such borrowers has dropped (-0.6 trillion rubles in the fourth quarter), they still account for nearly half of the total debt on retail loans (49.6%)".

An unusual decrease in borrowing is rare in Russia, as previously shown by Bank of Russia statistics. The last occurrence was witnessed in the second quarter of 2022, following harsh sanctions against the Russian financial sector and ultra-high key interest rates that peaked at 20% in February 2022 before gradually decreasing.

Loan Sharks in Retreat: The Struggle of High-interest Loan Borrowers

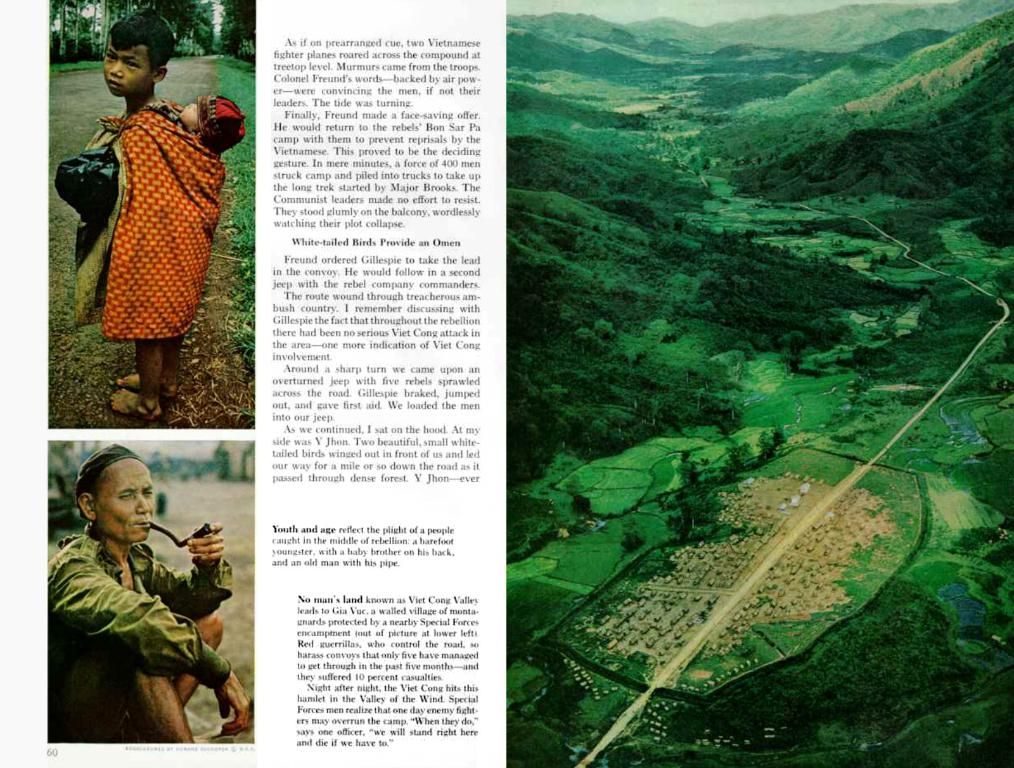

With the Bank of Russia maintaining historically high interest rates to contain inflation, lending activity has gradually cooled off, resulting in increasing defaults. In April, the Central Bank brought forth new measures to curb overheating in lending, ultimately compelling banks to adopt a more stringent approach in vetting borrowers. This tightened credit environment has surely left its mark on the borrowers.

Rich Pickings Ahead for Lenders: Central Bank’s Tightening Grip

Adding more fuel to the fire, the Central Bank frequently introduces measures aimed at cooling down the lending market, which leaves banks with no choice but to be selective in their funding decisions. In April, the CB was granted the authority to enforce macroprudential limits on mortgages to prevent the issuance of risky loans. As the regulator pointed out, these measures are necessary to prevent deteriorating credit quality.

[1] Central Bank of Russia: https://www.cbr.ru/[2] rbc.group: https://www.rbc.ru/[3] Bank of Russia: https://www.cbr.ru/base/statistics/emission/[4] Reuters: https://www.reuters.com/[5] Bloomberg: https://www.bloomberg.com/

- While the number of borrowers in Russia has significantly decreased, the number of individuals relying on microloans has experienced a boost, suggesting a shift towards smaller, potentially riskier loans.

- The average loan size has shrunk, hinting at a demand for smaller, more manageable financing options, which could impact the stability of businesses that rely on larger loans.

- The Central Bank's tightening grip on the lending market, through historically high interest rates and stringent borrower vetting, could lead to increased default rates, posing a challenge for businesses seeking finance.

- The Central Bank's measures to cool down the lending market, such as enforcing macroprudential limits on mortgages, could potentially limit the number of loans issued and force banks to be more selective, which in turn might affect the availability of finance for businesses.