A Snapshot of Big Yellow Group's Current Financial Status

UK's Top Self-Storage Company, Big Yellow, Up for Sale

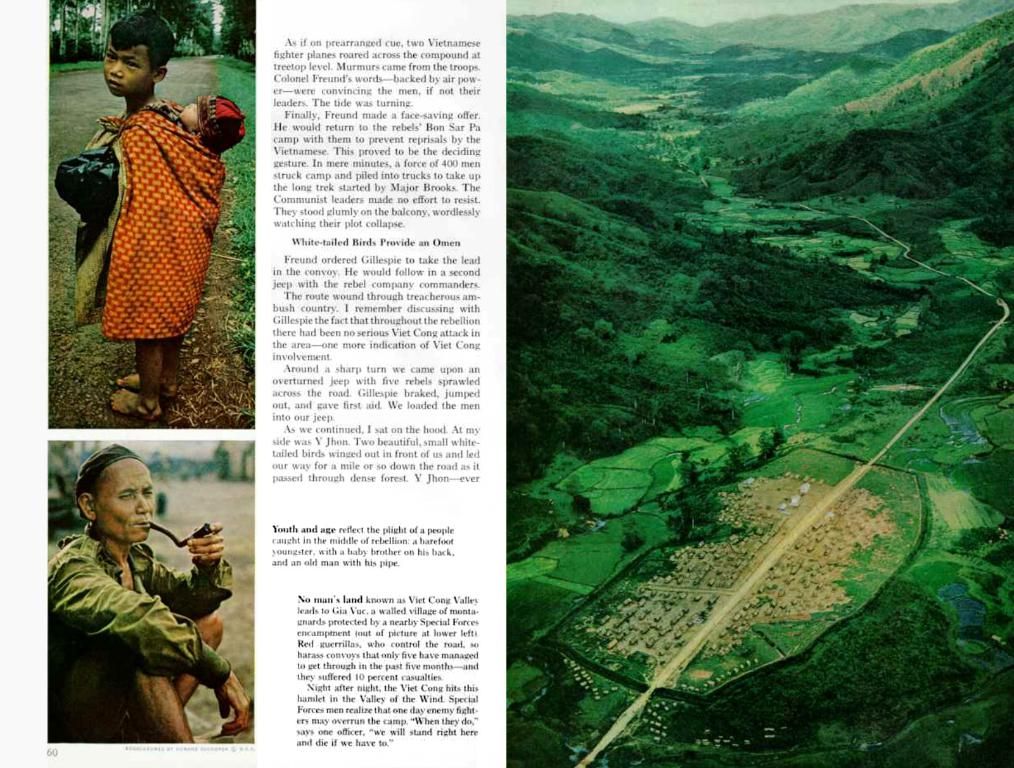

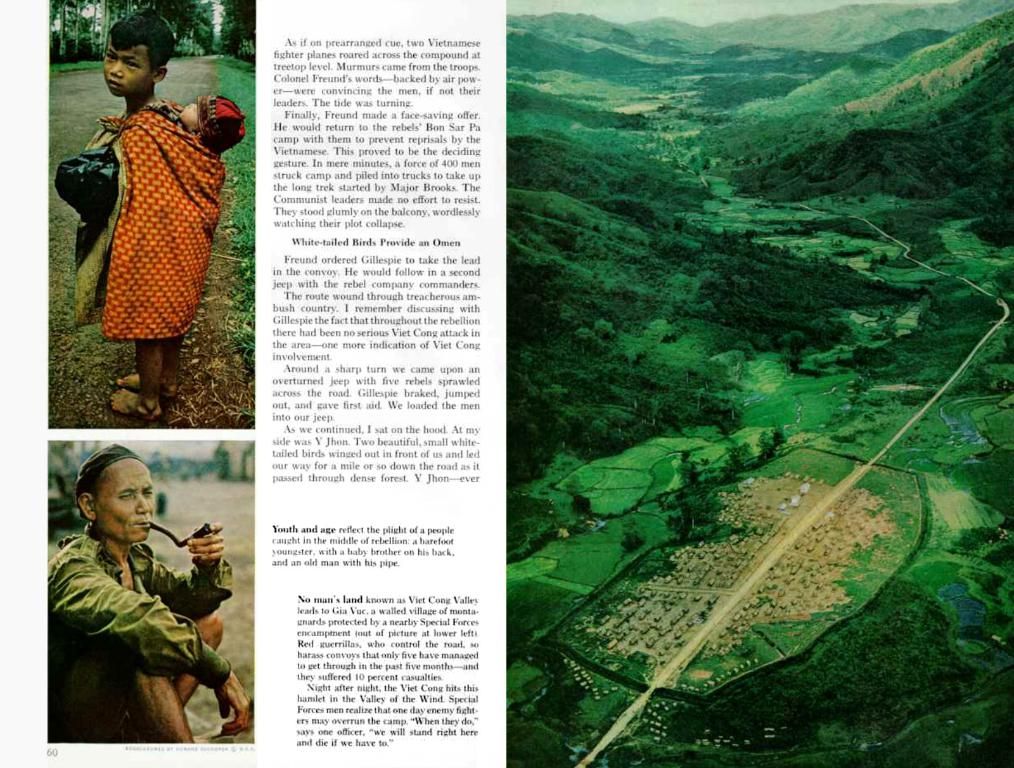

Hailing from the UK, Big Yellow Group PLC holds a coveted position as the nation's foremost self-storage operator, with an emphatic concentration on prime urban zones, particularly Greater London. Despite the macroeconomic nip in occupancy, the company has persistently churned out stable revenue growth, brisk cash generation, and a lucrative dividend, all while dodging the brunt of market pressure.

- Revenue Growth: The company's impressive revenue growth of 3.40% signals the maturity of its market position within a rigorously competitive setting [1][5].

- Return on Equity (ROE): Big Yellow's ROE of 11.04% underscores the company's nifty management of shareholder equity in generating profits [1][5].

- Free Cash Flow: Big Yellow's substantial free cash flow of approximately £77 million serves as a lifeline for future ventures and healthy dividends disbursements [1][5].

- Financial Health: Big Yellow flaunts strong financial fitness, as evidenced by robust profit margins and meager leverage, strengthening its technical indicators [2].

Peering into the Future

Big Yellow's future trajectory is shaped by a series of dictating factors:

- Valuation Metrics: With a forward P/E ratio of roughly 1,653.61, the company's share price suggests the market anticipates tall order growth or strategic revolutions [1]. However, it is presently trading at a discount to its NAV with a P/NAV of 0.80x, hinting at potential long-term upside as market sentiment elevates [3].

- Market Positioning: Big Yellow reclaims the title of the most celebrated brand in the UK self-storage market, including Greater London, affirming its competitive edge for upcoming opportunities [1][5].

- Investment Prospects: The turbulence in share price and the discount to NAV offer enticing opportunities for strategic investors, especially if future growth or strategic developments materialize [1][3].

The Road Ahead: Expansion and Challenges

Big Yellow's robust brand and impeccable financial health are trump cards, but maintaining a competitive edge in the high-stakes Greater London market necessitates continuous innovation and strategic expansion. The company's ability to strike a balance between growth-focused initiatives and cost-effective operational management will be crucial in preserving profitability.

In a nutshell, Big Yellow Group boasts a solid financial foundation, standing tall in its ability to sustain the robust growth expected in the self-storage industry, particularly in the wake of future market sentiment improvements.

- The financial health of Big Yellow Group, based in the UK, is robust, with strong profit margins and low leverage, reflecting its technical indicators [2].

- Big Yellow Group's future prospects are promising, as it holds the title of the most celebrated brand in the UK self-storage market, a position that can provide competitive edges for future opportunities [1][5].

- The company's strategic expansion, aimed at maintaining its competitive edge in the high-stakes Greater London market, will be crucial in preserving profitability [3].

- Strategic investors may find attractive investment opportunities in Big Yellow Group due to the turbulence in its share price and the discount to Net Asset Value, particularly if future growth or strategic developments materialize [1][3].