Trump's Electoral Victory Triggers a Dive in Shares of Clean Energy Companies. Could This Be a Prospect for These Two Sector Pioneers?

The election of Donald Trump on November 5 has sparked investors to speculate on which stocks might thrive or falter during the subsequent four years.

One early casualty has been stocks related to clean energy. With a probable Trump administration and a Republican-controlled House and Senate, investors fear the potential repeal of incentives for clean energy, introduced by the Inflation Reduction Act (IRA) of the Biden administration.

Add to this the possibility of Trump's tariff and tax policies fueling more inflation, which could create a challenging climate for clean energy stocks, which have already been affected by high-interest rates over the recent years.

However, the current downturn in these stocks might also present a chance for some savvy investors. Now could be the ideal moment to closely examine two top-notch clean energy industry titans that have seemingly been discarded.

Why clean energy stocks might not be as hard-hit as initially thought under the new Trump administration

There are two reasons why clean energy stocks might not be as risky as perceived in the Trump administration.

Firstly, although Republicans now control Congress, numerous clean energy projects are underway in predominantly Republican districts. Approximately 75% of the IRA's funding and job creation has been directed to Republican states or red counties within blue states.

While this fact didn't aid Vice President Kamala Harris' election, it might help prevent a complete repeal of those incentives. In fact, 18 Republican congressional representatives have penned a letter to House Speaker Mike Johnson urging against scrapping the IRA altogether due to the advantages they've observed in their districts. Although the Republicans are anticipated to retain a majority in the House, this margin is likely to be much narrower than 18 votes.

Secondly, Tesla CEO Elon Musk's support for Trump and financial contributions to his campaign could offer some influence over the administration's management of IRA incentives.

While there might be some adjustments around the borders of the policy, a full repeal of the IRA and its incentives appears improbable.

Rivian

Rivian (RIVN 11.15%), like numerous other electric vehicle (EV) stocks, suffered post-election losses. Nevertheless, the stock has largely recovered these losses after a promising update to the company's expectations in its recent third-quarter earnings announcement.

Rivian is still essentially a startup, as it continues to record losses. However, its high-end SUVs and the electric delivery trucks it's manufacturing for Amazon have given the company a strong foothold in two lucrative markets it currently dominates.

Rivian's high-end R1 SUV retails for over $70,000, implying its better-off customers might be less affected by high-interest rates or potential cuts in EV incentives from a Trump administration.

Furthermore, the company has recently sealed a high-profile deal with Volkswagen (VWAGY 1.11%), where Rivian will license its leading software and hardware technology for a joint venture and receive up to $5.8 billion through 2027 to fund its 2026 launch of R2 SUVs in the first half of 2026.

Rivian has also made strides in lowering raw material costs and capital expenditures, and even anticipates a positive gross margin in the fourth quarter. This improvement stems from several long-standing contract expirations as the new second-generation R1 platform ramps up, which features a significantly lower cost structure.

While Rivian still has a long way to go before achieving overall profitability, achieving a positive gross margin is a significant step ahead from the negative 40% or so gross margins observed in the previous year. Furthermore, the Volkswagen deal provides a vital source of funds as uncertainties surrounding interest rates persist.

In conclusion, Rivian seems to possess the high-profile partnerships, funding sources, and gross margin improvements that EV brands require to triumph in the new environment.

Enphase

Similar to other solar companies, Enphase (ENPH 6.75%) has faced significant stock losses following the election. However, the stock has been underperforming since interest rates soared in 2022, seriously impacting rooftop solar demand.

Despite this, Enphase remains a profitable industry leader. Its microinverter technology, applied to each panel of a system, is a superior alternative to string inverters, which only convert power from all panels simultaneously. The advantage of microinverters is that they increase overall system efficiency by eliminating the constraints of the weakest panel on a solar installation.

As a result, microinverters command a price premium over string inverters, enabling Enphase to remain profitable even in the challenging rooftop solar market over the past several years. Compare Enphase's performance to string inverter competitor SolarEdge:

ENPH Revenue (TTM) data by YCharts.

Enphase has taken extra measures to protect its profitability, recently shedding around 500 employees. Although unfortunate for those affected, it demonstrates management's readiness to cut costs and maintain profitability targets, despite Enphase's current profitability.

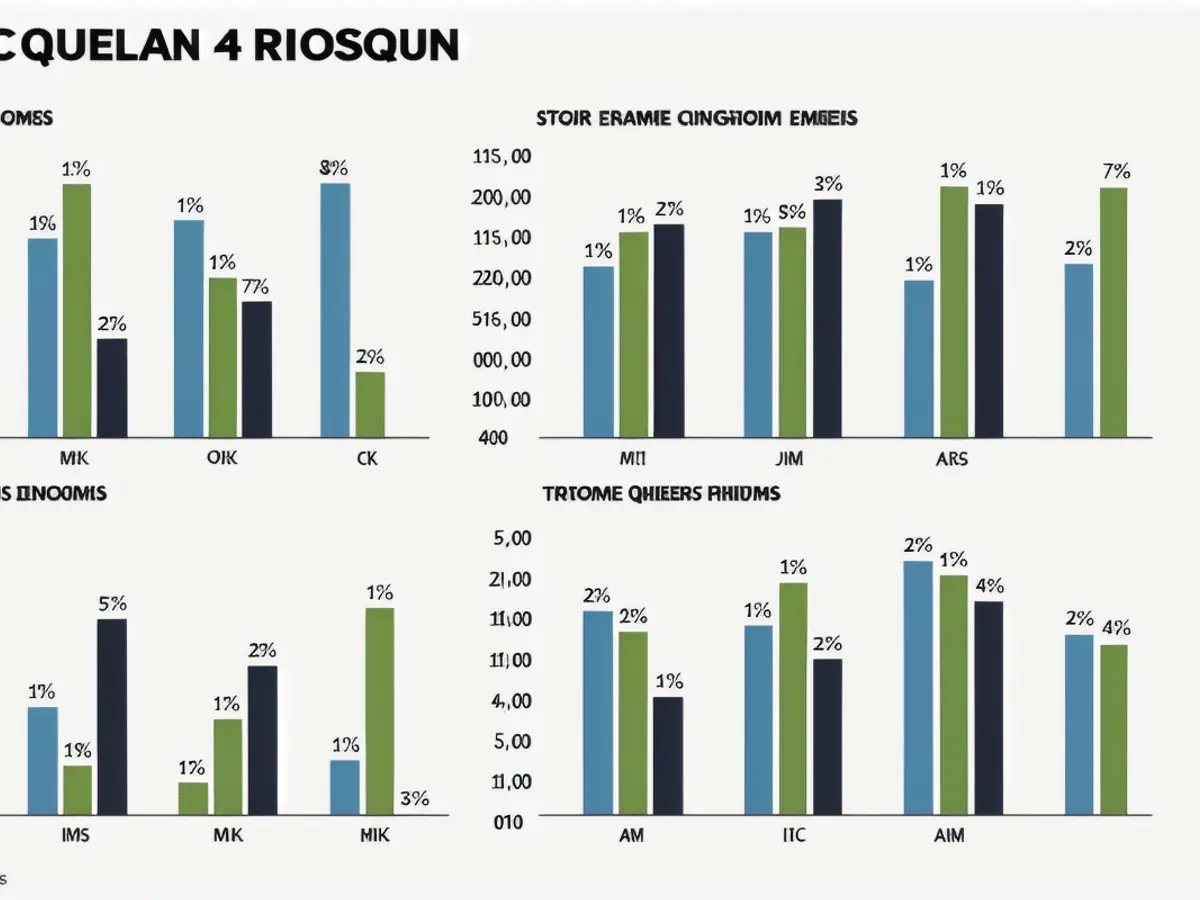

Furthermore, while revenue has plummeted dramatically over the past year, revenue and operating margins have improved in each of the last two quarters, as shown in the top left and bottom right panels.

Therefore, while the industry is still experiencing a significant downturn, Enphase's results suggest it might have hit rock bottom. And with its profitability surpassing that of all rivals, it has the potential to endure rivals who may collapse, putting Enphase in a strong position to benefit from the subsequent upturn.

Given the current situation with Enphase's shares, now priced at 18.5 times the anticipated earnings for the upcoming year and returned to prices last seen in 2020, it could be an opportune moment for investors with a contrarian mindset to focus on this solar industry frontrunner.

Despite the potential repeal of clean energy incentives and the challenging climate for clean energy stocks under a Trump administration, the situation might not be as dire as initially perceived. This is partly due to numerous clean energy projects underway in Republican districts and the support of Tesla CEO Elon Musk, who made financial contributions to Trump's campaign.

In the context of investing, the current downturn in clean energy stocks could provide an opportunity for savvy investors. They might consider examining top-notch clean energy industry titans that have seemingly been discarded, such as Rivian and Enphase, which have shown promising signs of profitability and resilience in challenging market conditions.