The Competition in Space Exploration Between the U.S. Has Ended. Now, Who Receives Investment Attention?

2024 was quite a rollercoaster year in the realm of space investments, boasting its share of triumphs and setbacks.

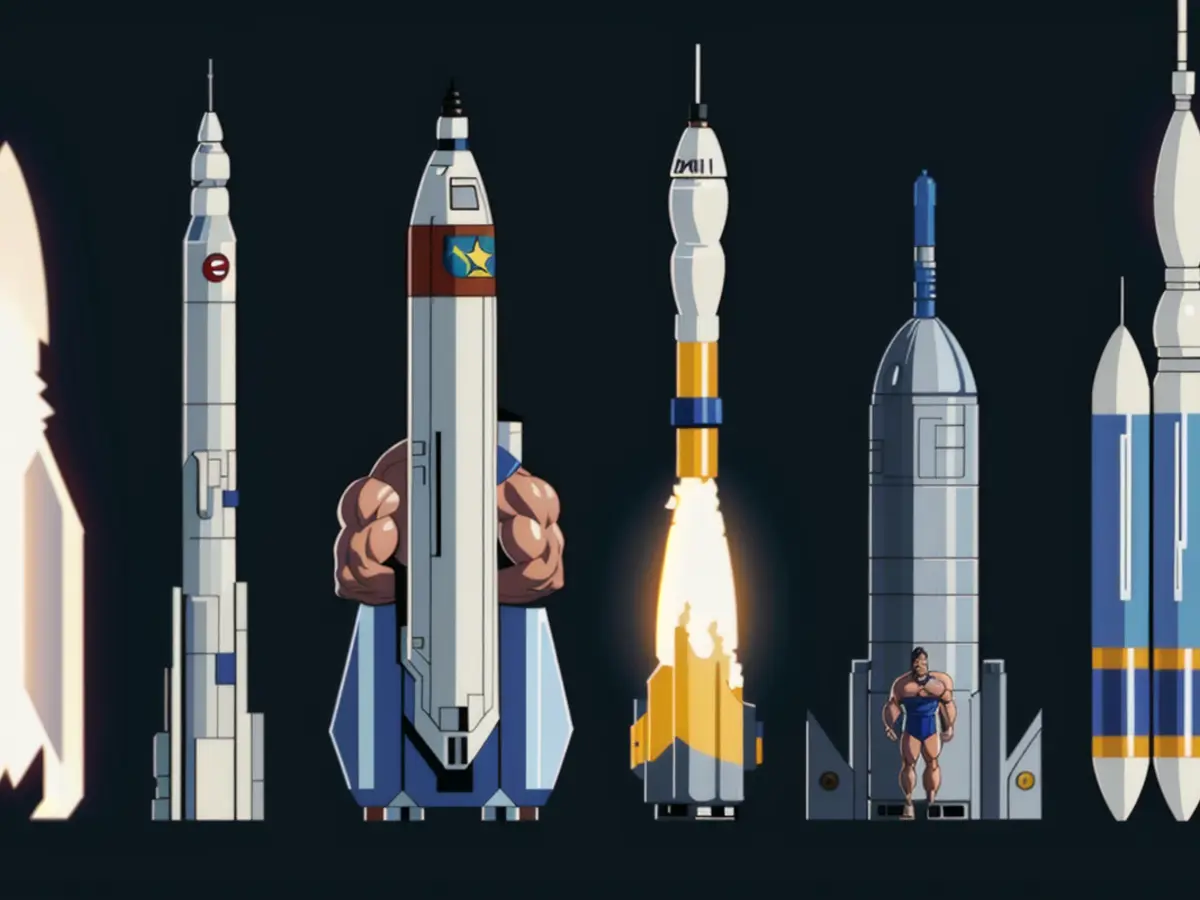

For SpaceX, the year was nothing short of spectacular, with an unprecedented number of 138 combined Falcon 9, Falcon Heavy, and Starship launches under its belt. This astounding achievement placed SpaceX at the forefront of space launches, significantly outpacing the rest of the world. Unfortunately, the cheer was not shared uniformly across the entire space industry.

2024 was unfortunately marred by a series of dramatic disasters in the space investing world. Astra Space, once a promising billion-dollar company, was reduced to a mere $0.50 per share after encountering seven unsuccessful launches in a row and narrowly avoiding bankruptcy. Faced with hardship, the company was forced to sell itself back to its founders. Similarly, ABL Space Systems, known for aiming to become a space launch company, repositioned its focus towards missile defense contracting for the Pentagon instead. Elsewhere, Relativity Space, once a darling of space investors, saw its private market valuation reverse amidst a rocket design change, forcing it to switch to a new, as-yet-untested model. Lastly, Virgin Galactic put its space tourism venture on an indefinite hold while they worked towards building a new spaceplane capable of resuming commercial flights by 2026.

In the wake of these devastating blows, it's fascinating to see which space stocks have managed to keep their footing.

Rocket Lab has emerged as a prominent force in the space industry recently. It successfully secured a significant contract win from the U.S. Space Force, launched rockets with greater frequency, and even boasts plans to unveil a new, larger rocket in 2025. Rocket Lab's stock price saw a fivefold increase in 2024, catapulting it to the second-most prolific rocket launcher in the U.S., second only to SpaceX. Despite competition dwindling presently, Rocket Lab has even capitalized on the absence of competitors to increase its prices, selling Electron rockets for an average of $8.4 million each in Q3.

Meanwhile, in Europe, Airbus subsidiary Arianespace seems to have weathered the storm of the Great Space Shakeout - at least, for the time being. After enduring a series of delays, Arianespace finally launched its Ariane 6 rocket in July, but has yet to follow it up with another launch six months later. The continued success of Arianespace will depend heavily on its ability to increase launch frequency and lower costs while remaining competitive with companies like SpaceX and Rocket Lab.

Lastly, in the good old U.S. of A., Boeing, Lockheed Martin, and their joint venture, United Launch Alliance (ULA), have forged an intriguing "show me" narrative for 2025. After successfully launching its new Vulcan Centaur rocket, ULA managed to secure a second launch before the year's end, despite encountering minor hiccups. ULA management promises to achieve as many as 20 launches in 2025, providing they can overcome regulatory challenges and secure the necessary approvals. If they manage to deliver on that promise, ULA could potentially breathe new life into both Lockheed and Boeing's space ventures.

A final mention goes out to Northrop Grumman, which has shown resilience in the space race as an underdog, despite only launching smaller rockets less frequently than its competitors. Through a partnership with privately-held Firefly Aerospace, Northrop Grumman is working on developing new versions of its Antares rocket and an entirely new rocket known as the MLV. While these new rockets are not expected to fly until 2026, Northrop Grumman remains an active player in this fiercely competitive industry.

In the realm of finance, investors who had placed their money in space stocks had a mixed experience in 2024. Despite the challenges faced by some companies, others like Rocket Lab, managed to thrive, with its stock price seeing a fivefold increase and securing a significant contract win.

Despite facing delays and a slower launch frequency, Arianespace, an Airbus subsidiary, has managed to keep its footing in the European finance market, largely due to its successful launch of the Ariane 6 rocket in July.