Swapping Essential Health Care Services for Superfluous Tax Reductions in Supply-Side Economics

Rep Public reps have initiated a budget resolution to reduce taxes again, likely reinstating some of the debated tax cuts from 2017, aka the TCJA. By extending these Paris-Trump tax cuts, funds would flow into the pockets of high-earners, sitting on record finances, ignoring innovation and growth. This move could drain U.S. Treasury of vital funds for government operations, including crucial programs like Medicaid and SNAP. This scenario isn't hypothetical; the current House of Reps bill includes potent cuts to Medicare and SNAP. With these cuts, they'd relinquish health and food access for vulnerable seniors, among other essentials, to finance TCJA extensions and leave behind substantial deficits.

The 2017 TCJA was based on the logic of boosting high-income individuals and corporations' income, pushing more money into savings monies, and lowering interest rates. That would, in turn, encourage investments in technology, plants, and infrastructure. This approach would result in enhanced job opportunities and increased wages, with workers benefiting the most. However, reality presented a vastly different picture.

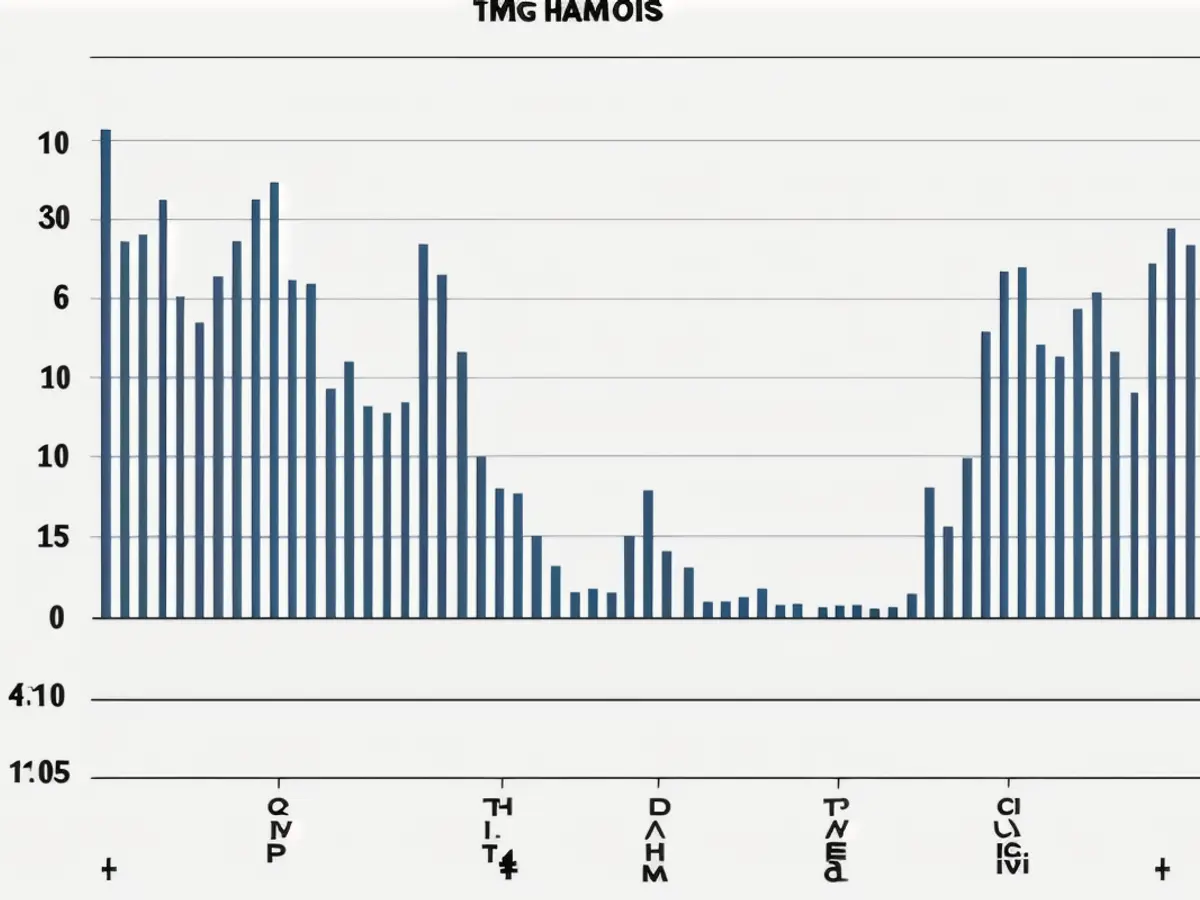

High-income households' increased liquidity following the 2017 tax cuts dramatically rose by $84,685, equivalent to a 24.7% jump from December 2017 to September 2024. The increased funds didn't lead to further investment but instead served as a revamp of their savings.

Corporations, on the other hand, boasted an enormous pile of cash reserves before the tax cuts, only to see their cash holdings swell even more in 2024, amounting to $8.0 trillion. However, the investment growth was far from what it was supposed to be. Instead, corporations sat on an even larger pile of money while investment as a percentage of GDP remained relatively unchanged, averaging 13.5% of GDP.

The TCJA tax cuts were doomed to failure from the start due to its reliance on faulty supply-side economic logic. Not only did the cuts fail to spur investment, but they also led to substantial budget deficits. Thus, policymakers should give up on the idea of extending these wasteful tax cuts and save vital programs like Medicaid and SNAP instead.

Here's an additional insight:

Extending the TCJA tax cuts would affect government-funded programs like Medicaid and SNAP, primarily hurting American families with low incomes. According to the House budget resolution, $880 billion would be cut from Medicaid to finance the extension. These cuts proportionately affect the bottom 20% of households, decreasing their household income by 7.4%, compared to no impact on the top 1% of households. SNAP, the food assistance program, while not directly cut, might face potential adjustments, leading to tax hikes or reduced services in low-income and disadvantaged areas. The tax cuts also substantially impact vulnerable populations since up to 61% of the benefits favor high-earners making over $500,000, presenting a significant burden on essential services for low-income families.

- The proposed budget resolution by Republican reps is likely to reinstate tax cuts from 2017, which could lead to significant cuts in Medicaid funds due to the redirection of resources.

- The reliance on tax cuts for high-income individuals and corporations, as seen in the TCJA, has been inefficient in boosting investments and stimulating growth, instead leading to substantial budget deficits.

- The extension of the TCJA tax cuts could lead to cuts in Medicaid and SNAP, potentially resulting in the loss of food and health support for vulnerable seniors and families with low incomes.

- Medicaid cuts of $880 billion, as proposed in the House budget resolution, are likely to disproportionately affect the bottom 20% of households, decreasing their household income significantly.

- The tax cuts could affect SNAP indirectly by leading to potential adjustments, such as tax hikes or reduced services, in low-income and disadvantaged areas.