Stock Ownership Rights in Question Following Elaine Wynn's Demise

Posted on: April 21, 2025, 05:02h. Last updated on: April 21, 2025, 05:04h.

Swipe right for some juicy insider scoop on Wynn Resorts!

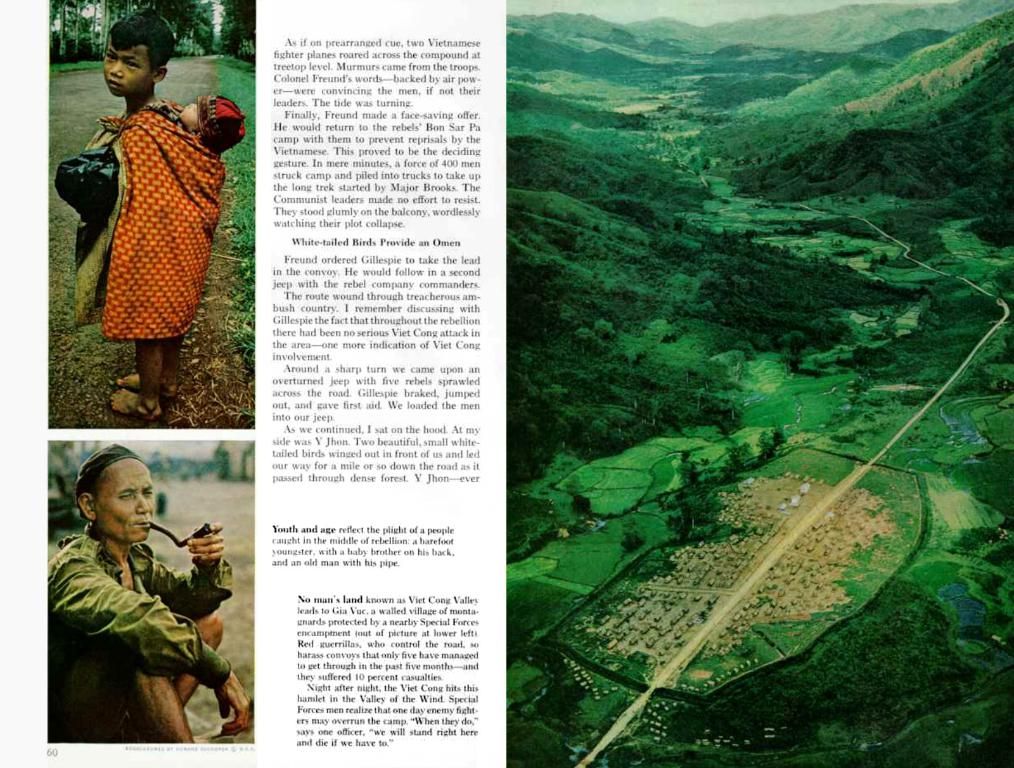

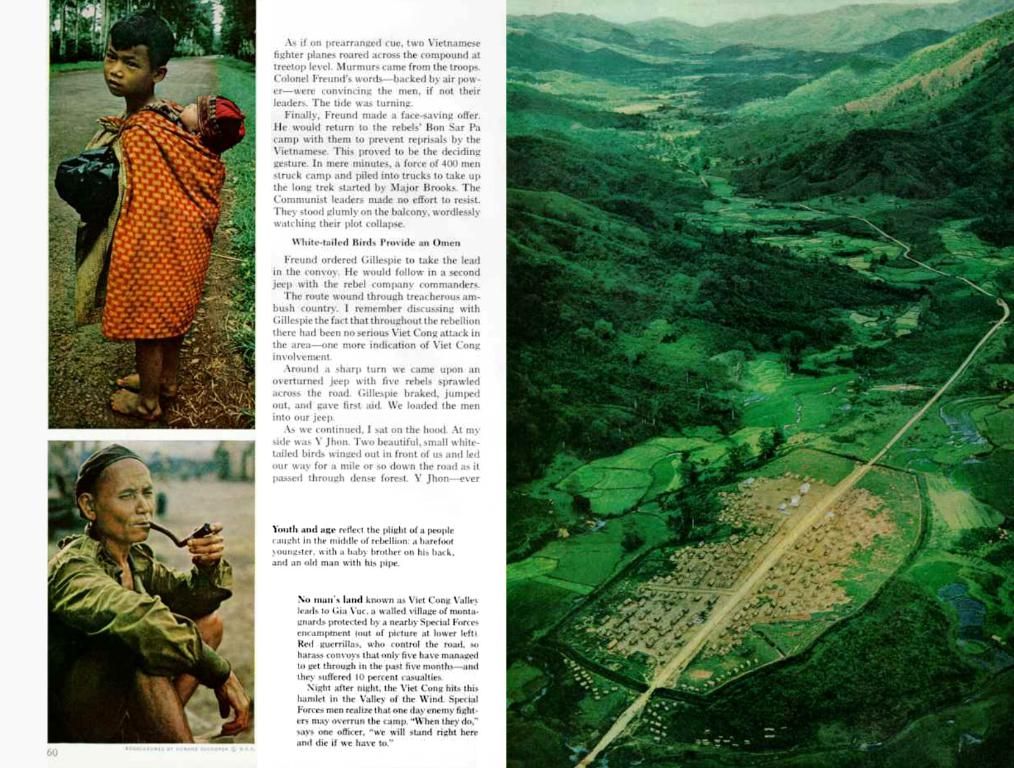

The recent demise of Elaine Wynn, a co-founder of this swanky casino operator, has raised some eyebrows regarding the fate of her substantial shareholding in the company. In the game of high-stakes business, Elaine controlled around 8% of the shares, making her the second-richest individual investor—just a notch below Tilman Fertitta. With her net worth estimated to be a cool $2 billion, she ranked 1,763 on the 2025 Forbes billionaires list and 16 on the 2024 list of "America's Self-Made Women."

R.I.P. Elaine Wynn left quite a legacy, but it seems there's been no word yet on what happens to her shares in the company. Jefferies analyst David Katz weighed in, acknowledging her death has stirred speculation about her shares' final destination. Katz questioned if anyone, particularly Fertitta given his growing equity stake in the company, would step in to claim her shares.

You might be wondering, "What's this Fertitta guy up to? He's buying stock left and right!" That's right, homie. When Fertitta first got his paws on Wynn shares way back in late 2022, he owned just 6.1% of the stock. But now, thanks to some dodgy, shady, but legal sneaky business, Fertitta has damn near doubled his stake, clocking in at a whopping 12% and usurping Elaine's position as the largest individual investor.

But let me lay some more knowledge on you. Katz reckons it's only natural for investors to mull over the consequences of Elaine Wynn's shares, Fertitta's cunning strategies, and the company's overall shareholder composition in the long run. however, Katz didn't predict that Fertitta or any other investor would outright gobble up Elaine's shares.

But listen up, 'cause things are about to get interesting. The Jefferies analyst sees stock opportunities galore, baby! He thinks the stock's cheap, boasting historical low valuations, inherent asset value—land and resorts—and solid business performance. He boldly declared, "We view the setup with multiple ways to win, given the historically low valuation, the inherent asset value, and the strong operating execution."

Now, no one yet knows if Elaine Wynn's heirs, her daughters—Kevyn and Gillian—are the only ones with a claim on Momma Wynn's Wynn Resort shares. Without the heirs publicly speaking up about their plans, it's uncertain if they'll sell the shares or donate some to charity. You might recall Dr. Miriam Adelson, a significant shareholder, sold billions of dollars worth of stock in 2023, only for Las Vegas Sands to snap it up with ease.

In conclusion, the casino industry's abuzz about the future of Elaine Wynn's shares, and while her family is acknowledged as the recipients of sympathy, the public is still waiting for the Wynn dynasty's official word on what happens next. The ball's in their court now—let's see what they do!

- Rumors are circulating about the fate of Elaine Wynn's substantial shareholding in Wynn Resorts following her death.

- Las Vegas, known for its entertainment and celebrity influence, is once again at the center of financial speculation due to Elaine Wynn's shares.

- Tilman Fertitta, another influential figure in the business and investing world, might potentially claim Elaine Wynn's shares in Wynn Resorts.

- Fertitta's growing equity stake in Wynn Resorts, fueled by some questionable but legal business strategies, has recently risen to 12%, surpassing Elaine Wynn's position as the largest individual investor.

- Jefferies analyst David Katz has expressed thoughts about the impact of Elaine Wynn's shares on the company's shareholder composition in the long run, but he does not anticipate Fertitta or any other investor outright acquiring them.

- Katz sees numerous opportunities in Wynn Resorts' stock, citing its low valuations, inherent asset value, and strong operating performance.

- The future of Elaine Wynn's shares remains unclear, as her daughters—Kevyn and Gillian—have yet to publicly speak about their plans for their mother's shares in the wealth-management business.

- The wrestling business, personal finance, pop-culture, and the world of self-made women billionaires like Elaine Wynn, all converge on this controversial issue in the finance and entertainment industries, making it a topic of interest for ETFGODFATHER and other industry observers.