"Ranking U.S. Presidents Worst to Best, One President Surpasses Others in Negativity"

Rewritten Article:

The S&P 500, one of the top U.S. stock market indicators, plummeted by 7.9 percent since President Trump took office. Financial analysts from CFRA Research argue that Trump's performance is lackluster compared to historical standards.

Trump's White House tenure clocked 100 days, yet it may feel like an eternity for some investors observing their investment portfolios. The unpredictable President has caused a stir in the financial markets with his ambitious trade policies, putting the world economy at risk, potentially triggering a global recession, and turning the entire global trade system on its head. Trump's public criticisms of the chairman of the American central bank, Jerome Powell, don't help inspire confidence among investors either. Consequently, the markets react.

The S&P 500, which mirrors the performance of the 500 leading publicly listed U.S. companies, dipped by 7.9 percent since Trump's inauguration on January 20, 2017. Although Trump's suspension or cancellation of tariffs and his U-turns in his rhetoric towards Powell brought some relief, the markets remain volatile. Trump's first 100 days in the stock market are dire.

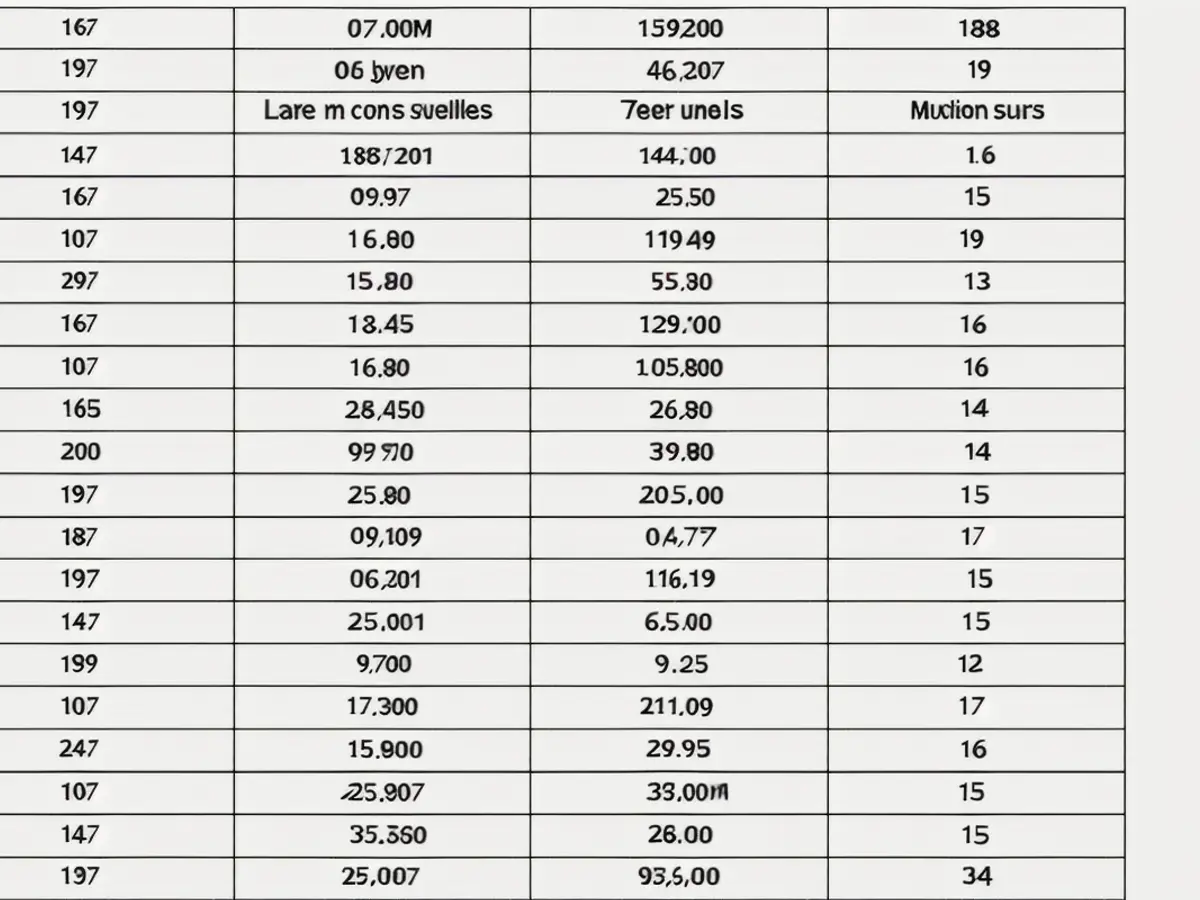

A study by CFRA Research highlights just how dismal this performance is. The analysts compared the S&P 500's development during the first 100 days of each presidential term since World War II's end. The results: Trump ranks second to last, with only Nixon's second term in 1973 boasting a weaker start (-9.9 percent).

Only those presidential terms commencing after a regular election were taken into account. For instance, Gerald Ford isn't included since he didn't win an election but merely took over the office from Nixon after his resignation. A total of 21 presidential terms were included in the study. Remarkably, only one-third of presidential terms began with a negative performance. The majority of presidential inaugurals are typically followed by a growth impulse for the stock market.

Leading the ranking are Franklin D. Roosevelt and Harry S. Truman, who gained 10.4 percent at the start of the 1945 recording. Roosevelt died shortly before the end of the 100-day period, and his vice president, Truman, took over on April 12, 1945. The price increases at that time were driven by the anticipation of World War II's end. The second-best result was achieved by John F. Kennedy, whose inauguration was celebrated by the stock market with almost a nine percent gain. Donald Trump's predecessor, Joe Biden, comes in third (8.5 percent).

Donald Trump considers the stock market as an indicator of his success and emphasized this several times. As late as December 2024, he said in an interview that "for me, the stock market – everything together, everything together – is very important." During his first term, Trump boasted about the gains in the stock market. In November 2017, he mentioned the booming markets to reporters while on Air Force One, implying that he had "always been good with money" and "always been good with jobs."

Trump's initial term started promisingly. The S&P 500 surged by five percent – the seventh best start. However, Barack Obama outperformed him twice, with the stock index rising by 8.4 percent in 2009 (rank 4) and 7.5 percent in 2013 (rank 6). Despite this, hope remains for Trump. A positive or negative start doesn't necessarily lead to a poor stock market performance for the entire term. For example, Dwight D. Eisenhower started with a 5.8 percent decrease in 1953, yet he ended his first term with a strong 70.7 percent increase in the S&P 500. Considering the current economic outlook and Trump's volatile behavior, it would take quite the imagination to anticipate a similar outcome.

Insights: The S&P 500’s volatility during presidential first 100 days can vary significantly based on economic conditions and policy developments. Although specific statistics regarding Trump’s unique S&P 500 performance are not available, the broader market trends during his 2025 term's first 100 days reveal high volatility and a near-bear market before a partial recovery[1]. Notably, the S&P 500's performance can often correlate with policy risks, such as Trump's tariffs that triggered sell-offs but delayed implementation fueled rebounds[1]. The lack of direct S&P 500 data in this case limits precise comparison, yet the 2025 period under Trump is marked by unusual volatility, in contrast to more stable beginnings seen in other administrations during non-crisis periods.

- The presidential term of Donald Trump has been a source of volatility for the S&P 500, with the index dipping by 7.9 percent since his inauguration.

- Financial analysts at CFRA Research found Trump's first 100 days in office to be one of the poorest performing periods for the S&P 500, ranking second to last compared to other post-World War II presidential terms.

- Trump's unpredictable policies, particularly his ambitious trade policies and public criticisms of the Federal Reserve chairman, have annoyed investors and contributed to the stock market's risks.

- The stock market's performance during Trump's first term has outperformed only Nixon's second term in 1973, but it has underperformed other presidential terms in general-news, particularly those of Franklin D. Roosevelt and Harry S. Truman.

- Despite the initial pool for Trump's presidency, the S&P 500's performance during his tenure has been significantly more volatile than in other administrations during non-crisis periods, potentially due to the president's political actions and general-news events.