Investing the sum of $200 in the Top Bank Share at Present Moment

Financial institutions, in particular, offer unique advantages to investors compared to other types of shares. They often are financially stable, well-established corporations that provide a shield in turbulent markets and dispense dividends.

However, if you're seeking a standout financial institution to invest in at the moment, allow me to suggest one that deviates from the norm. SoFi Technologies (SOFI -2.19%) is a mid-sized digital bank that embraces technology, otherwise known as a modern, tech-driven fintech. It's still young, only recently transitioning into profitability, and does not grant dividends. Yet, it could be the ideal financial institution to purchase with $200 in investments.

What makes SoFi special

SoFi originated as a student loan cooperative founded by college students. Loans for students remain a fundamental part of its portfolio, but it has since expanded into a multitude of loan and financial services. SoFi is transforming into a prominent banking institution that caters to students, young professionals, and users in search of an efficient digital banking platform.

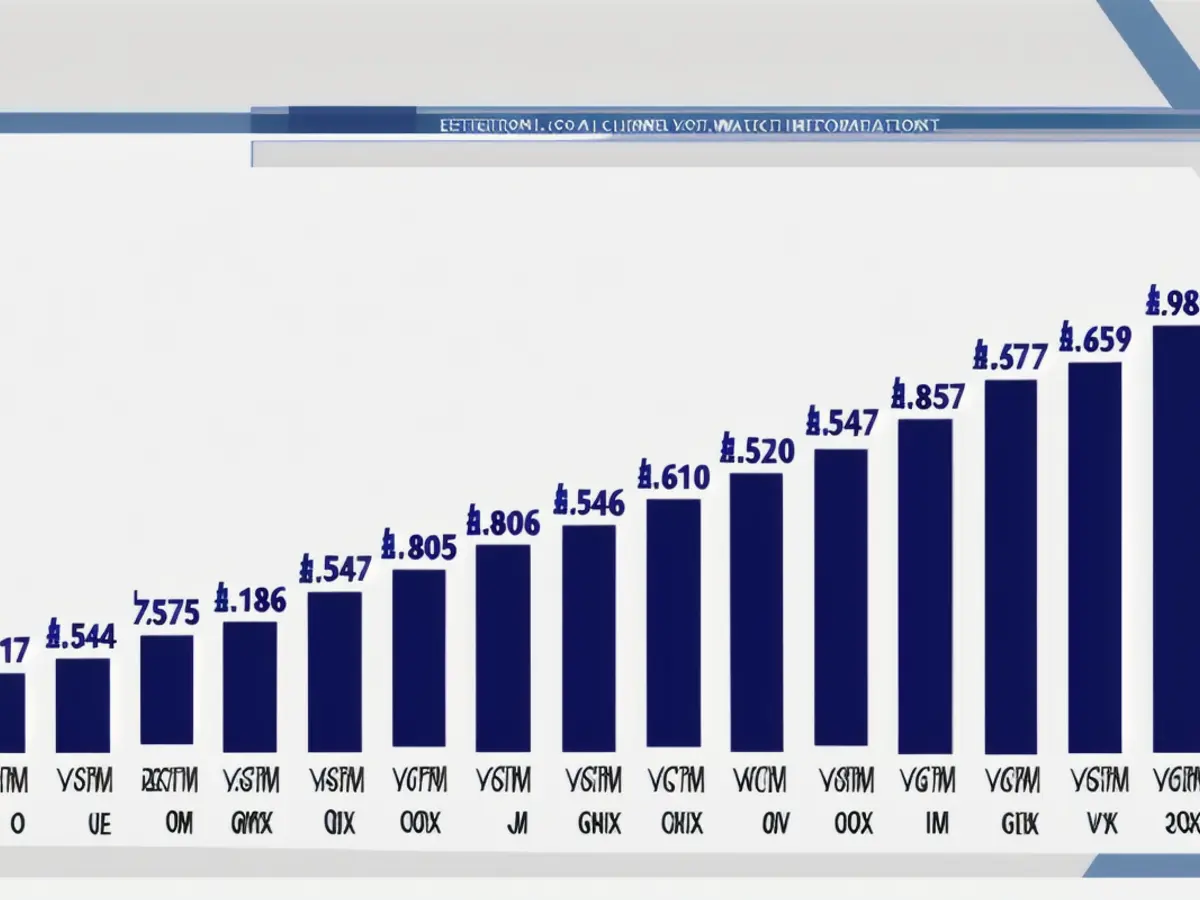

The number of these users is growing exponentially. SoFi is experiencing remarkable growth across its network, with substantial membership enrollments and product additions.

Revenue growth accelerated in the third quarter by 30% compared to the previous year. The non-lending sectors are contributing increasingly to this growth. This is significant because the lending industry is sensitive to interest rate fluctuations, and the recent volatility in interest rates has placed pressure on the lending industry.

In the third quarter, the non-lending sectors, which consist of financial services and technology, contributed 49% of total revenue, rising from 39% the previous year. They had a 64% increase in revenue compared to the same period last year.

Potential threats and opportunities

As SoFi expands its platform, it holds immense potential. With a rising number of members interacting with an increasing number of products, the company is scaling and reaching real profitability. It has reported positive net income for the past four quarters and anticipates this trend to persist. Net income was $61 million in the third quarter, up from a $267 million loss last year.

However, the business is not without risks. Many of these challenges stem from its dependence on lending, which still accounts for the majority of the revenue. Although the other segments are swiftly gaining ground, lending still forms the foundation of the company's profits and grows more slowly.

Lending contribution profit increased by 17% in the third quarter compared to the previous year to $239 million. Financial services contribution profit grew by 42% to $100 million, and tech platform contribution profit went up by 32% to $33 million.

It's just a matter of time before the other segments shoulder more of the burden. For now, as interest rates decline and SoFi benefits, the threats appear less daunting.

In the near future, there is risk because SoFi is still in the process of solidifying its footing in the industry. However, its performance so far has been promising, and in a decade, it should evolve into a much larger bank with the stability that comes with a more substantial size.

SoFi stock may skyrocket

SoFi stock may appear pricey at first glance, trading at a price-to-earnings ratio (P/E) of 160 and a price-to-book ratio of 2.8. However, as a high-growth stock and a tech stock, it's understandable that it's more expensive than a slower-growing bank stock. Regardless, according to certain valuation metrics, it falls within the same range as some larger banks.

SoFi stock does not offer the same protection and reliability as most established bank stocks, but it does provide high growth. In a decade, your $200 could be worth much more than it is currently as the stock's value could increase significantly more than any other bank stock.

Investing in SoFi Technologies could be an attractive option for those seeking high growth, despite its current high price-to-earnings and price-to-book ratios. As a tech-driven fintech, SoFi has the potential to outperform traditional banks in the long term.

With SoFi's rapid growth in membership and revenue, and its transition into profitability, investing $200 in its stock now could yield significant returns in the future. Finance experts suggest that tech stocks, especially high-growth ones like SoFi, have the potential to increase significantly more than slower-growing bank stocks in a decade.