Unleashing a Monster Relief: Germany's Cabinet Approves Massive Tax Breaks for Businesses

Government grants substantial tax reductions for corporations via approved legislature.

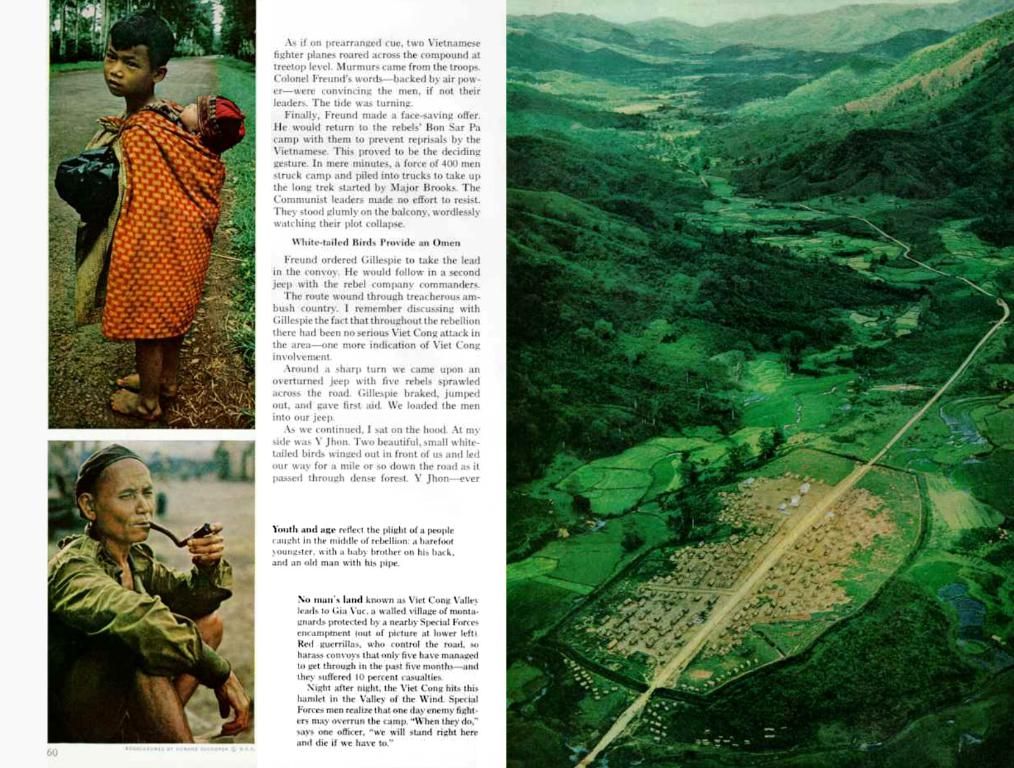

Get ready for some major shake-ups in the German economy! The federal government, in a bold move, has given the nod to a whopping one billion euro tax relief package to breathe new life into the struggling economy.

This mammoth relief, approved on Wednesday, will primarily work wonders for businesses, which, over the next five years, are looking at relief to the tune of approximately 46 billion euros. The federal government, states, and municipalities brace themselves for a drop in tax revenue of similar proportion, but resistance may not be far behind in the Bundesrat. Tune in to the Bundestag debate set for Thursday. If the process moves swiftly, expect all crucial decisions to be made by the summer break.

The bill unfurls a multifarious approach, with its primary components including generous super-depreciations of 30 percent on investments for three years and a planned decrease in the corporate tax rate by one percentage point starting in 2028. There's also a "green" push to boost electromobility in the form of an increased price cap on vehicles and a 75-percent depreciation option for the first year of acquisition. And let's not forget the boost to research funding.

Germany has been grappling with a two-year economic recession. Prognosticators predict a best-case scenario of stagnation in the current year. New Chancellor Friedrich Merz's government aims to transform the economic climate by the summer. With the current reliefs and planned state investments in infrastructure and energy price reductions, the government hopes to create a conducive environment for enterprise growth.

So, what's under the hood of this tax relief package?

The Heart of the Matter

- Tax Cuts for Businesses: The package includes a gradual reduction in the corporate tax rate from 15% to 10% by 2032. Some reports suggest the completion could happen earlier, by 2032 itself.

- Depreciation Boosters: Companies can deduct 30% of the cost of new machinery and equipment from their tax bills between 2025 and 2027.

- Electric Vehicle Perks: Electric company cars are in for preferential tax treatment. Buyers can claim 75% depreciation in the first year for purchases made through 2027.

- Research Encouragement: Additionally, measures are in place to stimulate investments in research and development.

Business Benefits

- Leveling the Competition Field: The package aims to make Germany a powerhouse once again by reducing business burdens and attracting investment in cutting-edge technologies and machinery.

- Encouraging Private Investment: By allowing substantial tax deductions on machinery and equipment, businesses are nudged into investing in new technologies, which can boost productivity and competitiveness.

The Investment Spark

- Tax Incentives: The package provides substantial tax breaks for companies investing in new machinery and electric vehicles, increasing the lure for both domestic and foreign investment.

- Research and Development Incentives: Encouraging research investments can lead to innovation and long-term economic growth.

Economic Fallout

- Engine of Growth: The package is engineered to put an end to Germany's economic stagnation by stimulating growth and making the country more competitive.

- Job Creation and Boosted Industrial Output: By boosting investment and competitiveness, the government envisions an increase in industrial output and potentially the creation of new jobs.

However, not everyone's in a jubilant mood. Critics caution that while the package offers short-term relief, it may not directly address deep-seated issues like sky-high energy costs and bureaucratic hurdles.

In essence, the tax relief package represents a significant attempt to breathe new life into Germany's economy. Will it steer the country towards a brighter future, or will it merely provide a Band-Aid solution to long-term economic woes? Time will tell.

The tax relief package, designed to revitalize the German economy, includes extensive provisions for businesses, such as a gradual decrease in the corporate tax rate and generous super-depreciations, which may positively impact the finance sector of various businesses. This financial relief, aimed at stimulating enterprise growth, could potentially influence employment policies within these businesses, thus contributing to job creation and boosted industrial output.