Elon Musk, head of Tesla, gives a bankruptcy caution in the U.S. amidst demands for a 'repair' influenced by Bitcoin.

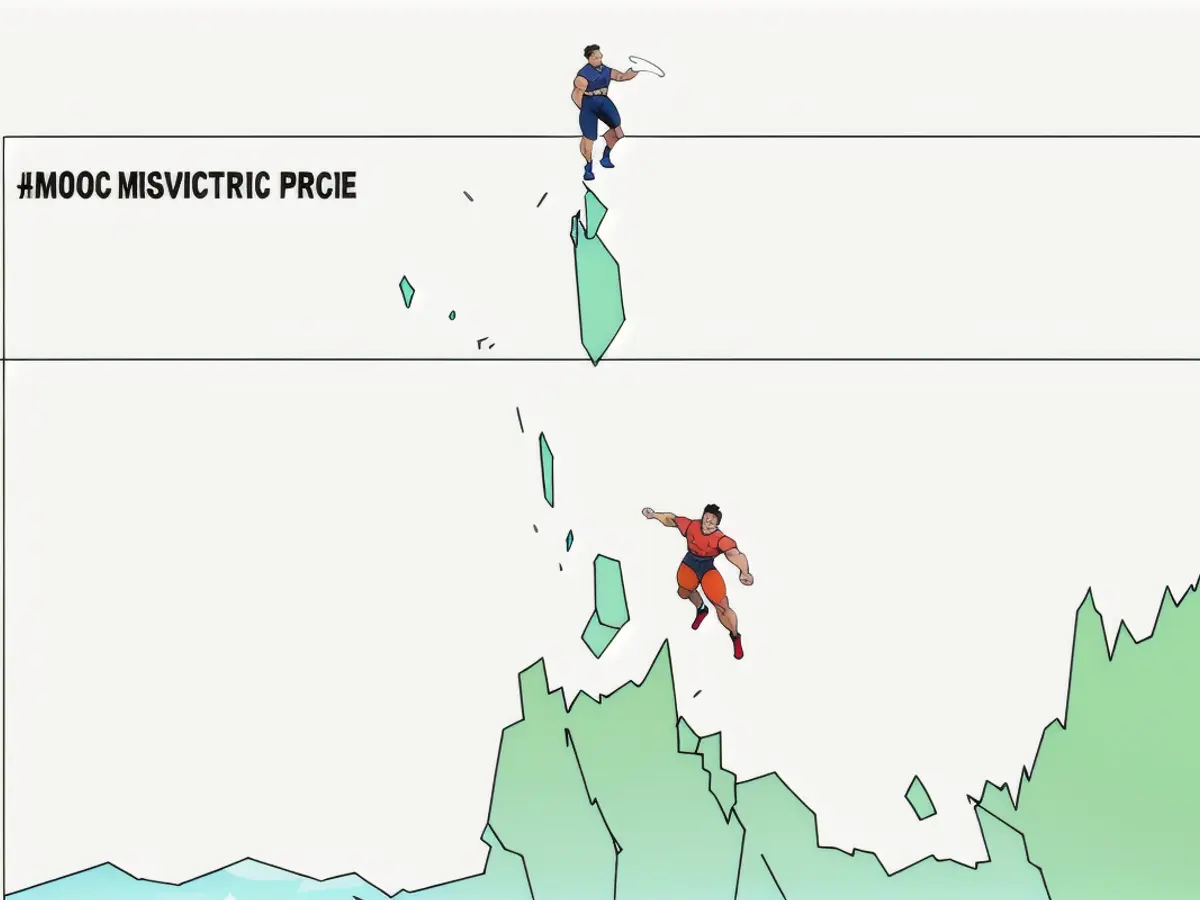

ElonMusk, the wealthy entrepreneur behind Tesla, has once more cautioned about impending U.S. insolvency, suggesting that a likely nightmare scenario from the Federal Reserve might be unfolding.

The price of bitcoin has spiked following the election of the new U.S. president, Donald Trump, boosted by his announcement of plans to establish a bitcoin strategic reserve. This move, which aims to combat escalating debt and stubborn inflation, has been well-received.

Trump has even been presented with a proposal for a "capital markets renaissance" driven by bitcoin, which could potentially unlock vast amounts of wealth. However, Musk has issued a stark warning, predicting that the U.S. will face a de facto bankruptcy if the situation isn't addressed.

Musk voiced his concern on social media, quoting a post from the prediction market platform Kalshi. This post highlighted the U.S.'s substantial spending problems, with the national debt currently standing at $36 trillion and continuing to grow. The post suggested a possible solution in the form of Musk's Doge Department of Government Efficiency, a concept named after the popular dogecoin meme.

The U.S. national debt has escalated significantly over the years, reaching $34 trillion by the beginning of 2024. The pandemic and related stimulus measures have significantly increased government spending, contributing to rising inflation in 2022.

Inflation rates over 10% led the Federal Reserve to raise interest rates at a record pace, which in turn has exacerbated debt interest payments and sparked fears of a "death spiral".

Musk's relentless crusade against excessive U.S. spending has culminated in the creation of the Doge Department Of Government Efficiency. Musk believes this department could potentially save the U.S. $2 trillion in expenditures.

The Doge department is inspired by the shiba inu doge meme, which is also associated with the popular cryptocurrency, dogecoin. Musk fondly refers to dogecoin as his favorite cryptocurrency and accepts it as payment at his Tesla company. Despite this, Tesla still maintains an inventory of around 10,000 bitcoins, worth roughly $1 billion, on its balance sheet.

Earlier this year, Trump even entertained the idea of using bitcoin to repay the U.S.'s whopping $35 trillion debt, suggesting distributing "little crypto checks" to debtors.

In July, Trump declared his intention to establish a "strategic national bitcoin reserve" and forecasted that bitcoin could surpass gold's $16 trillion market capitalization during a speech at the Bitcoin 2024 conference.

Later in the month, Trump publicly confirmed his intentions to create a U.S. bitcoin reserve.

"We're going to do something remarkable with crypto because we don't want China, or anyone else...to outpace us," Trump said to CNBC. "Yes, I believe so," he replied, when asked if the U.S. would set up a bitcoin strategic reserve akin to its oil reserve.

Republican senator Cynthia Lummis introduced a bill to Congress this year, titled the BITCOIN Act. This bill proposes for the U.S. to purchase 1 million bitcoins over a five-year period, aiming to alleviate the spiraling $35 trillion U.S. national debt.

Some bitcoin price and crypto market analysts have cautioned that the bitcoin price could plummet if Trump fails to deliver on his Bitcoin-related promises, however.

"The anticipation surrounding Trump has triggered a price rise—however, investors will be closely monitoring Trump's actions during his first 100 days in office," Ed Hindi, chief investment officer at Tyr Capital, a Swiss-based crypto hedge fund, said via email. "If Trump's actions do not align with his rhetoric, many investors may sell off their positions."

Elon Musk, being a supporter of cryptocurrencies like bitcoin and dogecoin, has also criticized the high debt levels in the U.S., suggesting that Tesla might eventually stop accepting bitcoin as payment due to its large holdings and escalating debt issues.

After Trump suggested using bitcoin to repay the nation's debt and establishing a strategic national bitcoin reserve, the price of bitcoin has shown a significant increase in relation to other cryptocurrencies, such as tesla's holdings of around 10,000 bitcoins.