Eligibility for Spousal Social Security Benefit: Crucial Facts to Consider Before Submitting Your Application

Rewritten Article:

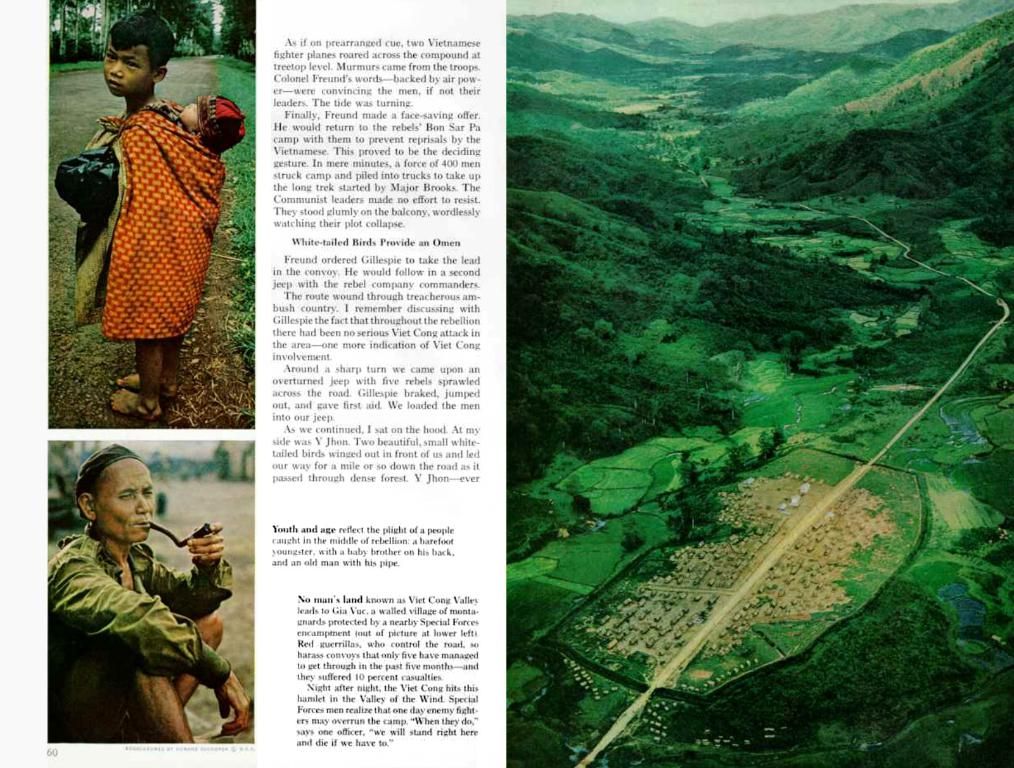

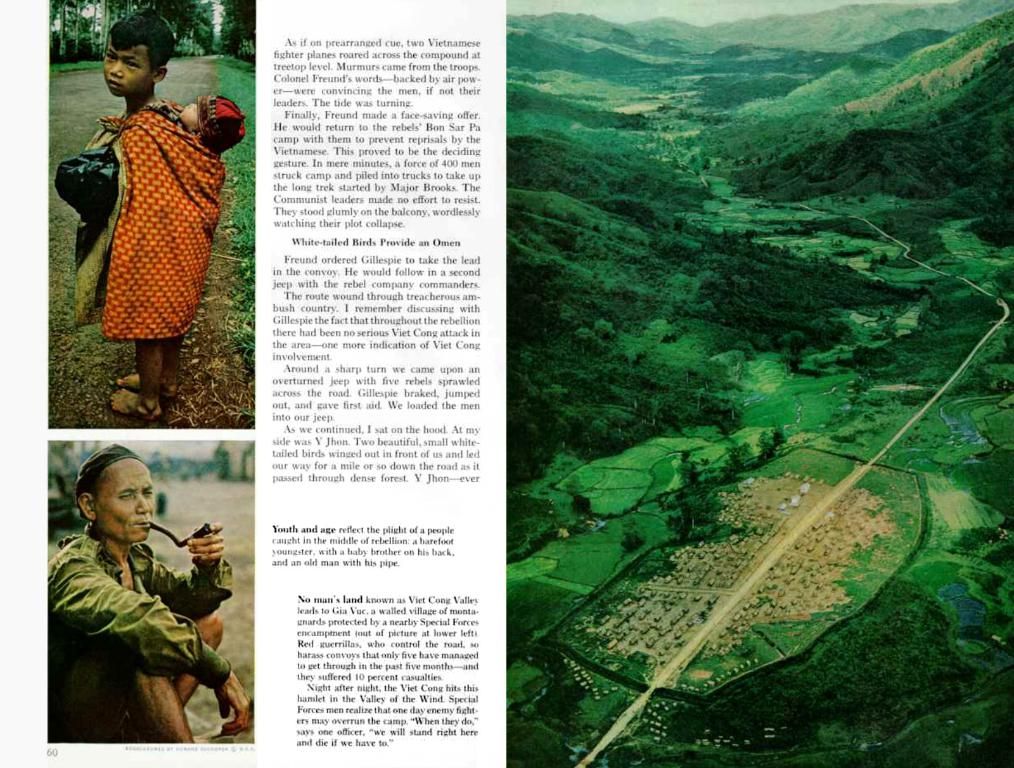

Tackling Social Security retirement benefits? Keep in mind the crucial role marital benefits can play in your household's income, particularly for couples who opted for a single-income setup. In these cases, the spouse who sacrificed career opportunities for family and home can still secure a substantial Social Security check.

But capitalizing on these benefits calls for more than a basic grasp of Social Security rules – the details matter. So if you want to make shrewd decisions for yourself and your family, be aware of these three essential insights before applying for spousal benefits.

1. The impact of early claiming or delayed benefits

You might know that when you claim benefits can significantly influence the size of your Social Security check. Early claims translate to smaller checks, while deferred claims mean larger ones. However, the rules aren't identical across different types of benefits.

Your spousal benefit amounts to half of your spouse's primary insurance amount (PIA), which they would receive if they claimed their personal retirement benefit at their full retirement age (FRA).

If you declare your spousal benefits before reaching FRA, you'll receive less than half of your spouse’s PIA. Detrimentally, the reductions for spousal benefits when claimed early are more severe compared to personal retirement benefits.

62

Let's look at how claiming spousal benefits early affects the total for a person with a FRA of 67 (those born in 1960 or later):

32.5%

| Claiming Age | Spousal Benefit Percentage || --- | --- || 62 | 32.5% || 63 | 35% || 64 | 37.5% || 65 | 41.7% || 66 | 45.8% || 67 | 50% |

(Source: Social Security Administration)

63

Also, it's worth noting that unlike with personal retirement benefits, there's no boost in spousal benefits after reaching FRA. Hence, it makes sense to apply by the time you reach FRA if you're claiming or planning to claim spousal benefits.

35%

2. Your spouse's claiming tactic can significantly impact your benefits

For you to be eligible for spousal benefits, your spouse must be actively drawing their Social Security benefits. In other words, if your spouse hasn't started Social Security or has stopped for any reason, you usually can't receive spousal benefits.

64

This complexity can significantly complicate your claiming decision, especially in marriages with an age difference. If the higher-earning spouse postpones claiming benefits until age 70 to maximize their monthly income, it could leave the older, lower-earning spouse with a meager benefit check. Although you can apply for personal benefits and switch to spousal benefits later, waiting might prove costly.

37.5%

Typically, it makes sense for the high-earning spouse to wait until age 70, though. That's because survivor benefits are equivalent to the amount they were receiving before passing away. However, every household has its unique circumstances, and this isn't always the ideal course.

3. You can collect spousal benefits based on your ex-partner's income history

65

You may be eligible to claim spousal benefits based on your ex-spouse's earnings history if you were married for at least ten years and haven't remarried.

41.7%

Remember a few essential details:

- Your ex will never be informed by the Social Security Administration about you receiving benefits based on their earnings record. Furthermore, their benefits aren't affected by your claim.

- If you've divorced for at least two years, you don't have to wait for them to start collecting benefits in order to become eligible for benefits based on their earnings record.

66

You may also be entitled to survivor benefits based on your ex-spouse's earnings, provided you satisfy the 10-year requirement. The only exception is if you remarried before turning 60.

45.8%

Simply contact the Social Security Administration to inform them that you wish to switch to spousal benefits based on your ex-spouse's record. They'll inspect your eligibility when informed, but they generally don't make the election for you. Making this switch could significantly lift your retirement income and help you enjoy a more comfortable retirement.

50%

- Key Eligibility Requirements:

- Marital Status: Your spouse must be eligible for Social Security benefits.

- Age Requirement: You must be at least 62 years old to claim spousal benefits.

- Spouse's Benefits: The spouse must have filed for their own retirement benefits to enable you to claim spousal benefits.

- Ex-Spouse's Eligibility: If divorced, you can collect spousal benefits based on your ex-spouse's earnings record provided you were married for at least ten years, haven't remarried, and aren't married to someone else with a higher earning history.

- Claim Timing:

- Early Claiming: Claiming spousal benefits before FRA will result in reduced benefits.

- Late Claiming: Delaying the claim can lead to increased benefits.

- Proper Timing: Timing is crucial. One spouse may claim earlier while the other delays for maximum benefits, particularly survivor benefits.

- Survivor Benefits:

- Higher Benefits: Post the passing of your spouse, you may be eligible for survivor benefits, which can be higher than your own retirement or spousal benefits.

- Consultation:

- Expert Advice: Navigating Social Security rules can be complex. Consulting a financial advisor can help you navigate the system and avoid costly mistakes.

67

- The amount of a spouse's spousal benefit is calculated as half of their primary insurance amount (PIA), which they would receive if claiming at their full retirement age (FRA).

- Early claiming of spousal benefits results in less than half of the spouse's PIA, with more pronounced reductions compared to personal retirement benefits.

- To be eligible for spousal benefits, the spouse must be receiving their Social Security benefits. Delaying the higher-earning spouse's benefits can complicate the claiming decision, especially in marriages with an age difference.

- It's possible to collect spousal benefits based on an ex-spouse's income history if certain eligibility requirements are met, such as being married for at least ten years, not having remarried, and being at least 62 years old. This can significantly lift retirement income, especially survivor benefits if the ex-spouse passes away.