Eight Potential Threats Jeopardizing the 2025 U.S. Stock Market Performance

As the New Year's celebrations of 2025 conclude, anticipate some turbulence in the U.S. stock market. The market's exuberance from 2024 might prove to be a double-edged sword, leading to a phase of readjustment in 2025.

Eight key factors are contributing to the stock market's wobbliness:

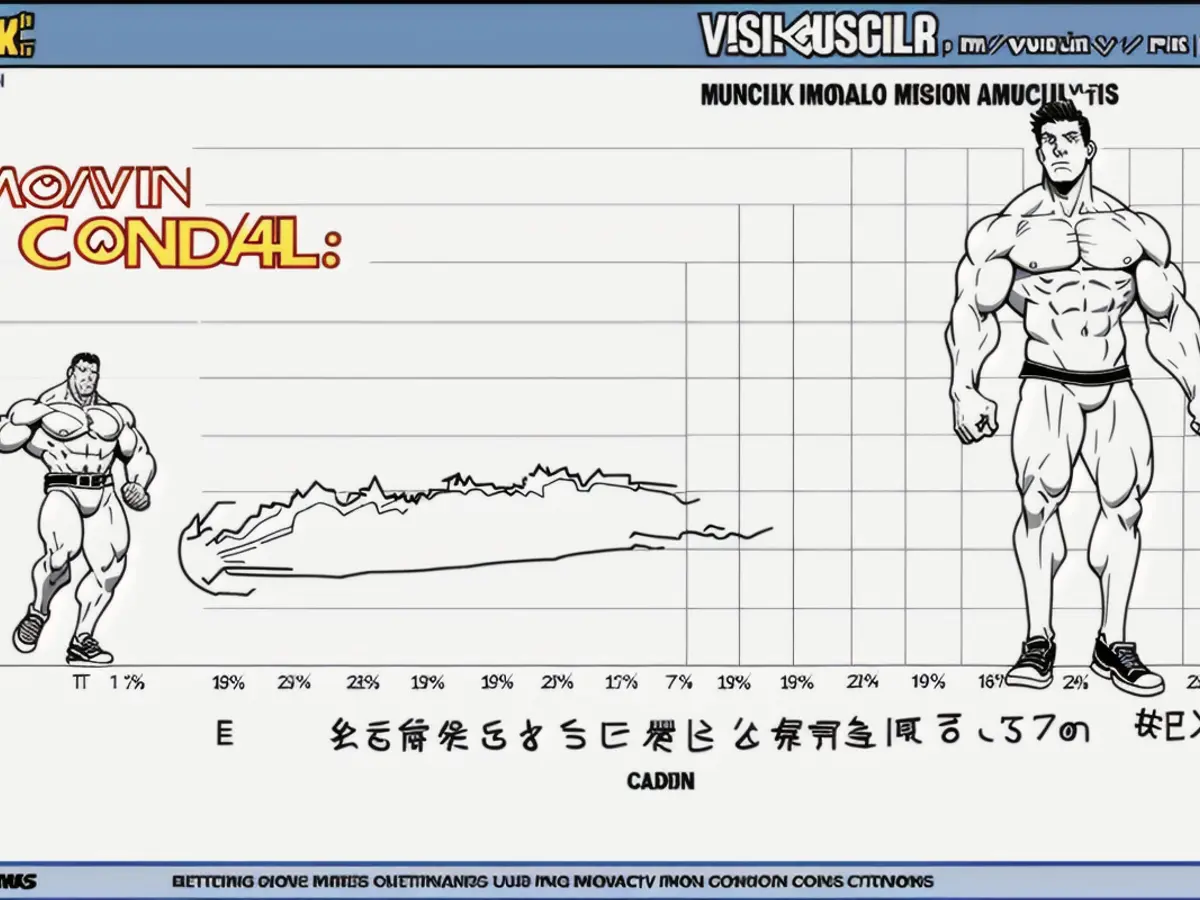

Initially, the stock market's growth rate surpasses the actual growth of company earnings and other essential elements (refer to the graph at the article's end)

Subsequently, the bond market is attempting to separate itself from the Federal Reserve's questionable initiative to reduce interest rates once again

Thirdly, inflation isn't extinguished yet, so keep an eye out for the typical revival of prices in the first quarter, coupled with potential tariff-induced price increases.

Fourthly, the stock prices of homebuilders are falling. Overoptimistic management teams are now grappling with an unusually large amount of unsold houses

Fifthly, the U.S. government's financial situation is inconsistent, but achieving consensus to rectify it will prove challenging, as recent House difficulties with the debt limit indicate

Sixthly, conflicts. Although wars abroad don't usually distress Americans, domestic complications can instill worry or fear, causing optimism to dissipate

Seventhly, climate change. The impact is becoming apparent, but who will bear the cost of repairs, rebuilding, relief, and relocation? What preventative measures will be taken, and who will decide and implement them?

Eighthly, hubris (excessive pride or self-confidence). With President Trump's character, major disruptive or reconstruction initiatives are likely to result in unintended and damaging consequences - the law of "unforeseen consequences" in action.

The conclusion - More than just an optimism adjustment is required

The challenges facing the U.S. are profound, surpassing the usual scope of the stock market's consideration. However, eventually, the stock market's conduct reflects these fundamental issues and influences investor sentiment. As a result, the joyous finish of 2024 for the stock market might face a substantial downward correction starting in early 2025.

As indicated in "first," here's the almost five-year Covid period graph that shows two major fundamental issues: the earnings gap and the inflation-adjusted reality. Both factors contain negative aspects that support a pessimistic outlook for the stock market.

In light of the 2025 investment outlook, the stock market might experience a significant correction after its exuberance in 2024. Analyzing the 2025 outlook, these challenges, such as the earnings gap and inflation, could lead to a readjustment in the market, as suggested by the graph's trends from the past five years.