Berkshire Hathaway's Cautious Cash Reserve 📊

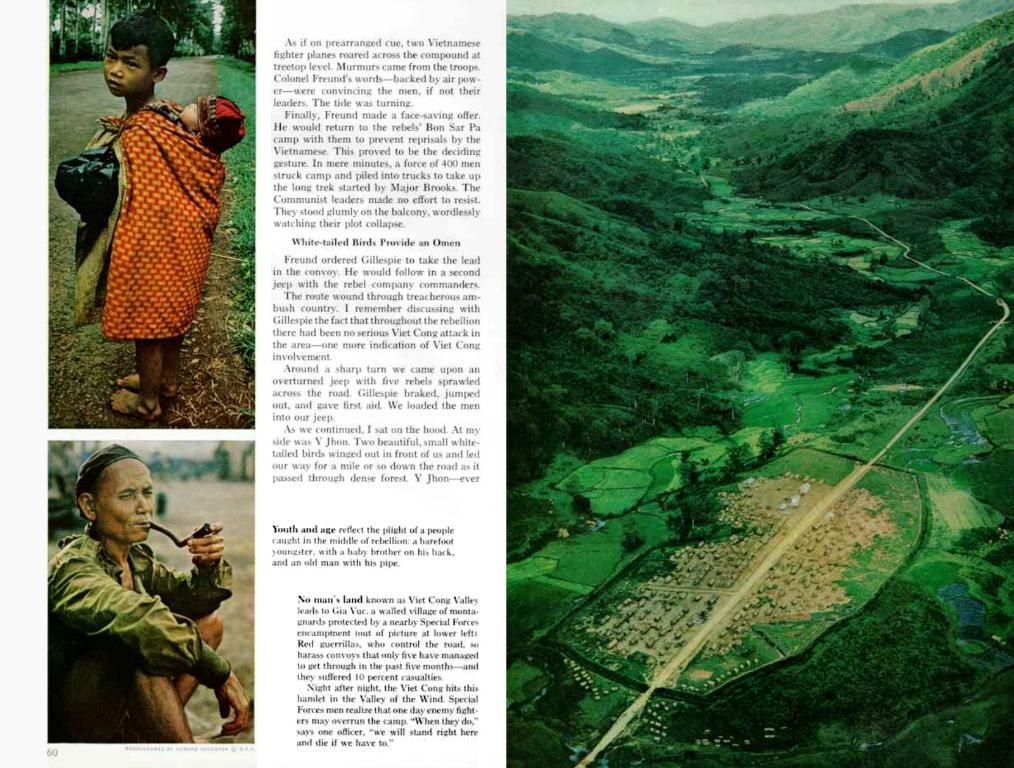

Berkshire Hathaway's Operational Earnings Reduce, Simultaneously Marking a Peak in Cash Reserves

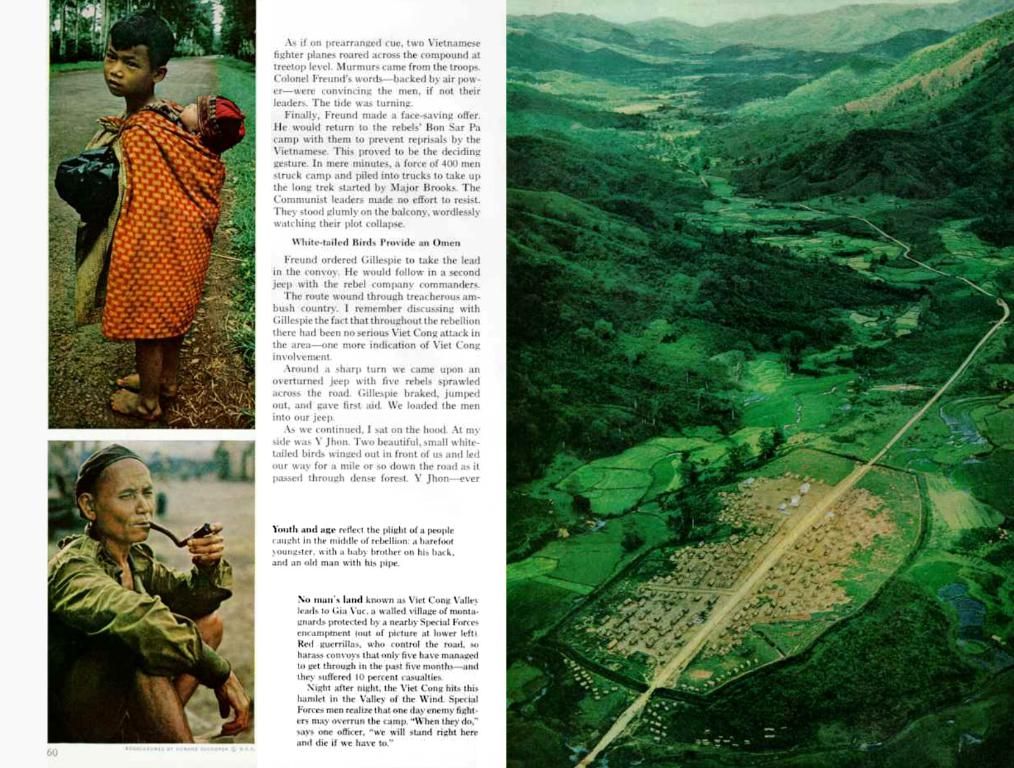

Warren Buffet's investing empire, Berkshire Hathaway, recently reported a 14.1% fall in their first-quarter operating earnings compared to the same period last year. The Omaha-based conglomerate reported operating earnings of $9.64 billion, a drop from $11.22 billion in 2020.

The dip in earnings was mainly due to a hit taken by Berkshire's insurance underwriting business. Interestingly, the company now boasts a record $347.7 billion in cash, cash equivalents, and short-term investments, a significant increase from $334.2 billion in the last quarter. This cash pile has sparked curiosity amongst investors, wondering how and when Berkshire might deploy it.

Last year, Buffet hinted that there were few investment options that met Berkshire’s stringent criteria. The annual shareholders meeting, which attracts tens of thousands of visitors, is scheduled shortly, providing a platform for Buffet to discuss the company's first-quarter earnings and the current economic landscape.

Berkshire's Class B shares have fared well this year, gaining 19%, while the S&P 500 has dipped a bit more than 3%. Friday's gains brought the benchmark index backs to its pre-"Liberation Day" levels.

Insights into Berkshire's Cash Reserve 🤓

Berkshire's cautious approach with its massive cash pile can be understood through a few key points:

- Strategic Positioning: Berkshire's cash reserves have grown by nearly $10 billion since late 2024, largely due to strategic sales of equity holdings like Apple and Bank of America, coupled with a halt in share buybacks.

- Defensive Positioning: Buffet views the cash as a "war chest," enabling the company to take advantage of future opportunities when high-quality assets become available at reasonable prices.

- Market Conditions and Investment Philosophy: Buffet's reluctance to deploy capital stems from his core value investing principle, preferring to buy quality assets at reasonable prices. In the current high-valuation market, he prefers to wait rather than invest at unfavorable valuations.

- Market Volatility: In a tumultuous market where tech giants faced losses in 2025, Berkshire's substantial cash reserves protected the company from significant losses, as tech stocks like Apple experienced gains that Berkshire missed while holding cash.

- Future Deployment Plans: The substantial cash pile provides Berkshire with the flexibility to seize attractive investment opportunities when they arise. However, there's ongoing debate about whether this cash represents a missed opportunity or a prudent strategy.

- Equity Investment Commitment: Buffett assures shareholders that Berkshire will continue to invest a substantial majority of its funds in equities, with a focus on American equities with significant international operations.

In conclusion, Berkshire Hathaway's cash reserve is a strategic tool, carefully hoarded to ensure readiness for future investment opportunities when market conditions improve.

- Berkshire Hathaway's colossal cash reserve of $347.7 billion, a substantial increase since late 2024, has been boosted through strategic sales of equity holdings such as Apple and Bank of America, with a halt in share buybacks.

- Warren Buffet views the cash as a "war chest," positioning Berkshire to advantageously take part in future opportunities when high-quality assets become available at reasonable prices.

- Buffet's reluctance to deploy capital is grounded in his classic value investing principle, preferring to purchase quality assets at reasonable prices rather than investing at unfavorable valuations in the current high-valuation market.

- Berkshire's cash reserves protected the company from significant losses during market turbulence in 2025, as tech stocks like Apple experienced gains that Berkshire missed while holding cash.

- The substantial cash pile offers Berkshire the flexibility to seize attractive investment opportunities when they arise, though debates continue about whether this cash represents a missed opportunity or a prudent strategy. Furthermore, Buffett reaffirms Berkshire's commitment to investing a substantial majority of its funds in equities, with a focus on American equities with significant international operations.