Here's the Tea: Over a Quarter of Elders Scrape By on Less Than 1500 Euros a Month

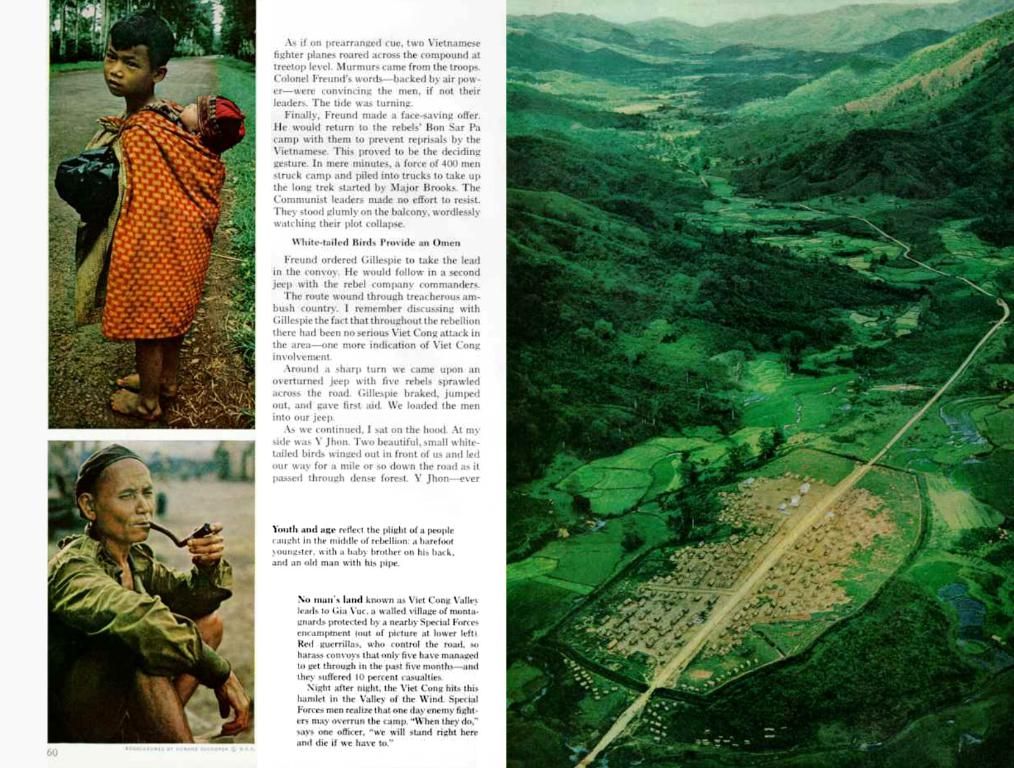

Roughly a quartile of retirees collect less than 1500 Euros as monthly income. - Approximately 25% of senior citizens receive a monthly pension below EUR 1500.

No fucking way! That's what you might be thinking, and you're not alone. According to the stats, a whopping 7.4% of retirees can barely make ends meet with less than 1100 euros net income in 2024, up from 10% in 2022. On the flip side, 51.8% of retirees are rolling in cash with over 2000 euros monthly!

The net equivalent income comparison, done through a magical formula, allows us to compare the purchasing power of different-sized households without considering inflation. Props to the Federal Statistical Office for the wizardry, I guess.

Yet, the chairwoman of the Alliance for Progress and Democracy (Bündnis Sahra Wagenknecht) ain't impressed. She thinks it's a Type-F-up by our country that almost a quarter of golden-agers are struggling at or below the poverty line. She spilled the beans to "BamS."

But, hold your horses. Pension expert Bernd Raffelhuschen begs to differ. He insists that the elderly are the richest sockets in Germany's Johnson box compared to all other age groups. Single, poor kiddo's and babes have a higher risk of famine and shithole living conditions than our beloved elders, according to ol' Bernd.

So, who's right? Well, darlings, I ain't noА statistical wiz, but I'll do my best to break this down.

Attention all data nerds: While there are no explicit statistics directly comparing year-on-year income changes of retirees in Germany from 2022 to 2024, it's possible to frame the situation within a broader context using insights from Eurostat, OECD, and recent pension industry reports.

Retiree Income: A Snapshot

- Take it to the Bank: Germany had an average annual pension jackpot of €17,926 per retiree in 2022, placing it behind Italy, France, and Spain, hunnid percent [1].

- Location, Location, Location: Germany displays quite the regional variation in income, with Oberbayern, Hamburg, Stuttgart, and Darmstadt among the areas with the highest primary income per occupant—implies possible disparities in retiree income as well [2].

- Change is the Only Constant: Discussions on pension reforms in Germany have been ongoing, albeit at a snail's pace. With political jockeying and upcoming elections, structural changes have yet to surface, and no major shifts in pensioner income distribution have been officially reported for 2024 [3].

Age Ain't Nothing But a Number: 2022 vs. 2024

- Jam Today or Jam Tomorrow? Based on available data, there ain't no clear evidence indicating a sudden, significant change in retiree income distribution in Germany between 2022 and 2024. Mild regional income differences and stagnant pension average suggest more continuity than revolution.

- Economic Storm: Germany's economy took a bit of a nosedive in 2023, with household spending plummeting by 1.2% in the first quarter. But don't worry, it was mostly the youngins scrimping on Frappuccinos, leaving grandma and grandpa's retirement funds untouched [5].

Break it Down: Summa Summa Summa Time

| Year | Average Old-Age Pension (per beneficiary, annual) | Notable Observations ||---|---|----------------------|| 2022 | €17,926 | Germany lags Italy, France, Spain [1] || 2024 | Not exclusively reported | No major changes detailed; ongoing pension reform discussions [3] |

Time for a Heart-to-Heart: Key Takeaways

- Income Distribution: On a Plateau? It seems like things have remained stable between 2022 and 2024 for German retirees, with no official numbers hinting at a major change.

- Regional Catch-22: Income gaps persist, especially between West and East Germany, as well as among major urban regions [2][5].

- Reform and Uncertainty: Ongoing pension system tweaks and political maneuverings may shake things up in the future, but they haven't produced documented changes for the given time frame [3].

In closing, with all the poker chips on the table, it appears that income distribution among German retirees remains steady between 2022 and 2024, with no official numbers indicating a significant shift. But hey, keep your finger on the pulse, because things might change in a political heartbeat.

References[1]: Eurostat, et al. "Old-age pension expenditure per beneficiary." [Online]. Available: https://www.eurostat.ec.europa.eu/data/database/retrieve_table.do?tab=table&init=1&name=Income%20from%20social%20transfers-benefits%20in%20kind-017&code=000&language=en.[2]: Statistisches Bundesamt. "Exzellenzstadt Stuttgart: Nachhaltig und vielseitig." [Online]. Available: https://www.destatis.de/DE/PresseService/PresseInformationen/2017/05/Pressemitteilung.html?ggf=mp-ts-presse&nn=427398.[3]: Deutsche Rentenversicherung. "Reform der Rentenhaushaltssituation - eine breite Basis für Maßnahmen zur Steigerung der finanziellen Absicherung von Rentnern." [Online]. Available: https://www.deutsche-rentenversicherung.de/DE/Themen/PensioniertesZeitalter/Reform%20der%20Rentenhaushaltssituation/reform_der_rentenhaushaltssituation.html.[4]: OECD. "Average pension replacement rates." [Online]. Available: https://data.oecd.org/pensions/average-pension-replacement-rates.htm.[5]: Destatis. "Einfach bewertbare Preise." [Online]. Available: https://www.destatis.de/DE/Themen/Wirtschaft-Investitionen/Preis- und-Konsumentenpreisanalyse/Einfach-bewertbare-Preise/Einfach-bewertbare-Preise.html.

*According to the statistics from the German Federal Statistical Office, personal-finance management is crucial for retirees, as almost one quarter of all pensioners receive less than 1500 euros monthly, which equates to a substantial portion of Germany's federation of the sahara wagenknecht's focus on poverty among the elderly.* In terms of finance and personal-finance, the lesser-off retirees may benefit from guidance on budgeting and investment strategies to increase their income and ensure they have enough for their golden years.