Affordable Infrastructure Investment-Grade Securities Offered at a Discounted Price of 64 Cents.

Checking Out Brookfield Infrastructure Partners' Fixed-Income Securities

Venture into the world of Brookfield Infrastructure Partners' (BIP) debt securities as we unpack their recent drop in value

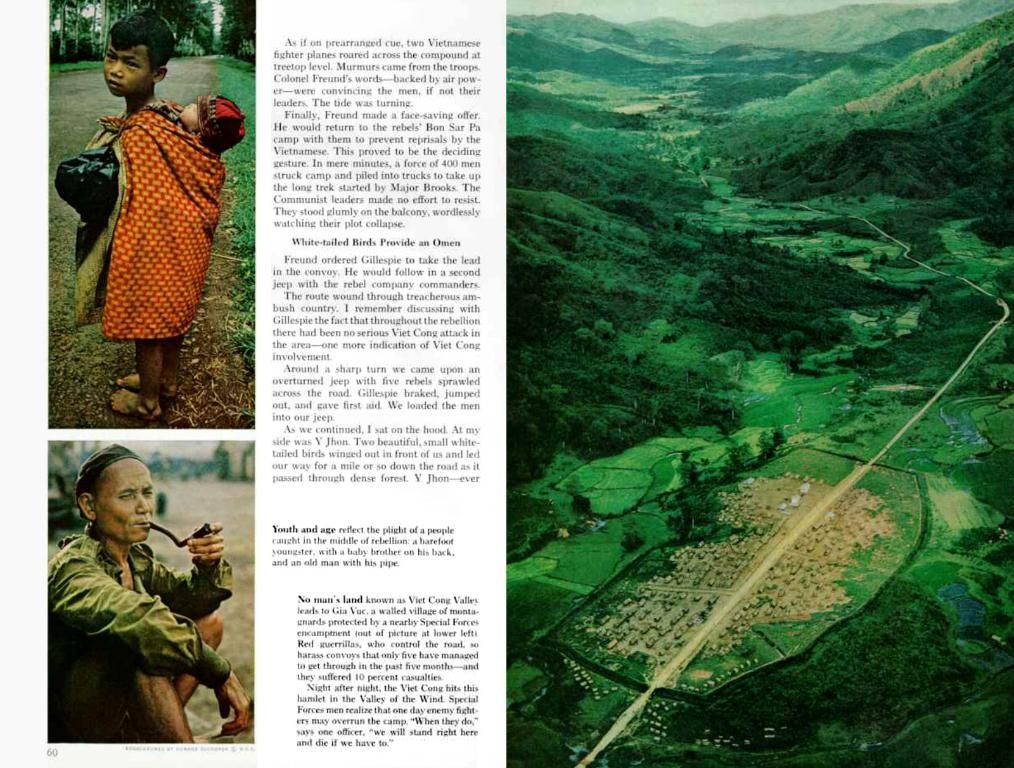

It's a bumpy ride for BIP's fixed-income securities these days. They've taken a moderate nosedive, following the surge in credit spreads we witnessed post-market mayhem. Let's dive in and decipher the reasons behind this sell-off.

Credit Spreads and Their Gravitational Pull

Broadly speaking, widening credit spreads equate to a perceived escalation in market risks or interest rates. Consequently, fixed-income securities, particularly those linked to capital-intensive infrastructure corporations, get a heavy push downwards as investors demand bigger yields to cover their perceived risks[1].

Tightening Belt: The Role of Federal Policies

Although specific details are scant in their results, it's likely that broader market conditions, like elevated interest rates, caused BIP's refinancing costs to climb, affecting investor sentiments towards their debt[5].

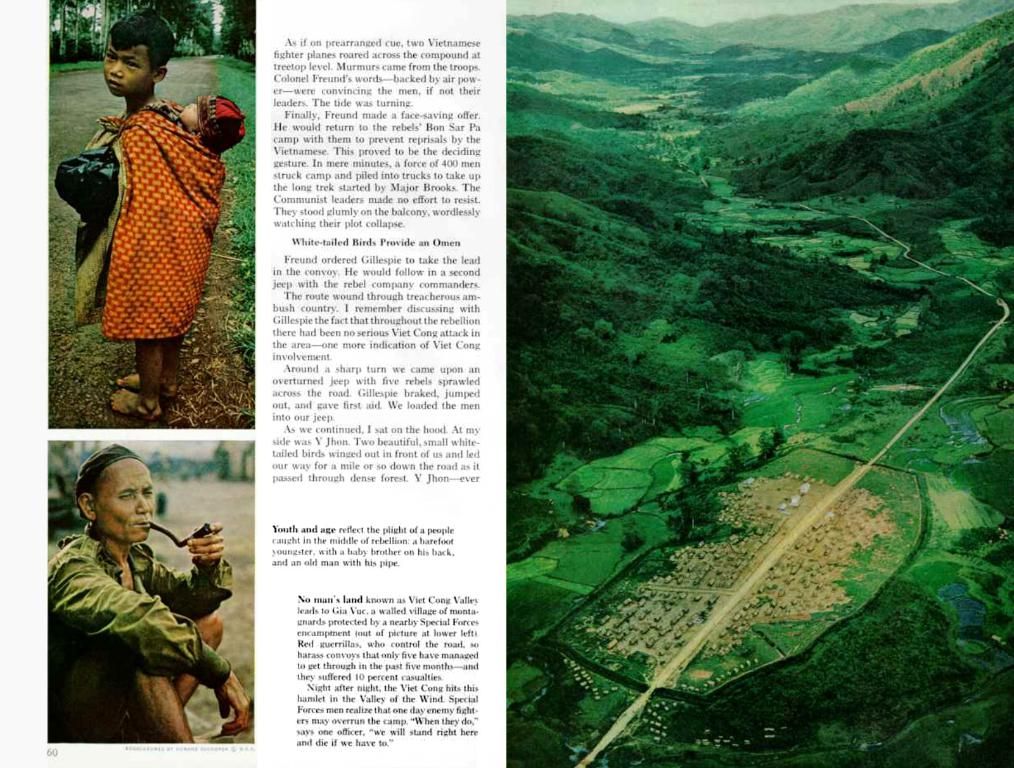

Pockets of Strain: Operational Concerns

Although BIP flaunted a 5% FFO growth to $646 million in Q1 2025, segments like transport saw a FFO downturn ($288M vs $302M YoY). This potential instability in cash flow could raise eyebrows about the operational soundness of certain ventures[5].

Hedging and Market Quakes: A Delicate Dance

The company shared mark-to-market losses on hedging activities during Q1, potentially stirring up financial turmoil that influenced the debt valuations[5].

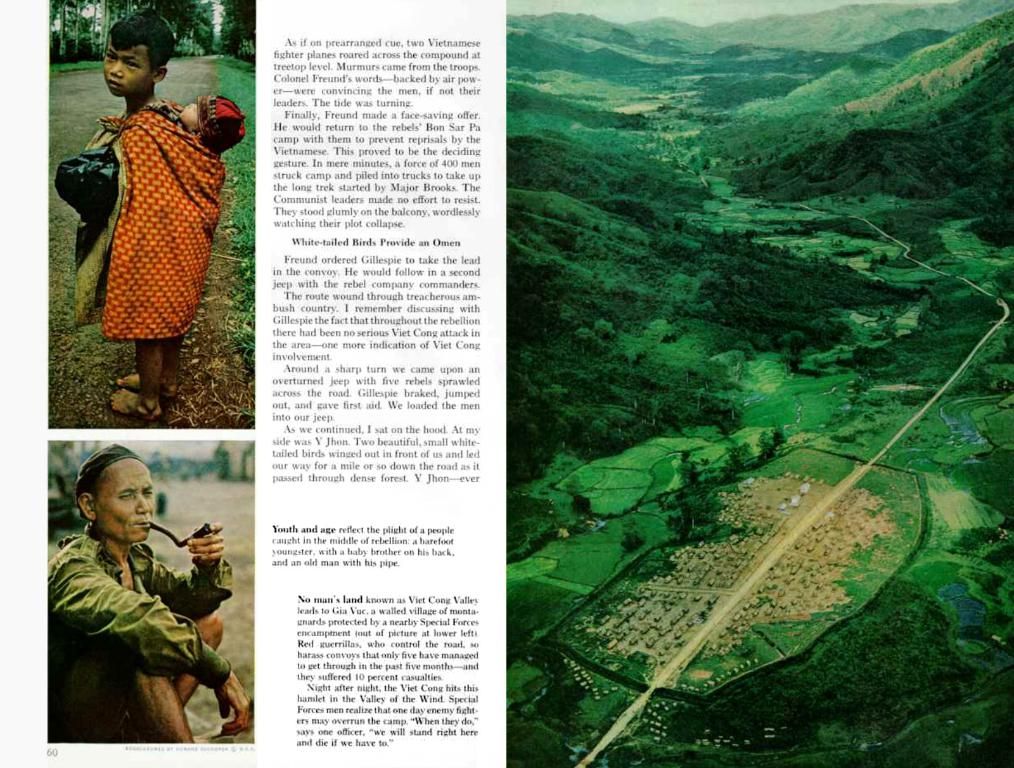

That being said, BIP's core strength remains formidable. Despite the challenges, the firm commendably increased its dividend by 6% and bolstered its liquidity through $1.4B in recent asset sales[5]. This resilience points towards a brighter future for BIP's debt securities, despite the current sales slip.

Investing in Brookfield Infrastructure Partners' (BIP) fixed-income securities requires a moderate level of risk due to the recent drop in their value, which can be attributed to the widening credit spreads in the market that increase perceived risks for such investments. These widening credit spreads are often a result of surges in market turmoil and higher interest rates, causing a heavy push on the prices of fixed-income securities tied to capital-intensive infrastructure corporations like BIP.

Another factor contributing to the sell-off could be the rise in BIP's refinancing costs due to broader market conditions, such as elevated interest rates, which affects investor sentiment towards their debt. Additionally, operational concerns may also impact BIP's debt securities, as seen in the potential instability in cash flow of certain segments like transport, which experienced a decline in FFO (Funds From Operations) year-over-year in Q1 2025.

Despite these challenges, it's worth noting that BIP demonstrated resilience by increasing its dividend by 6% and securing $1.4B through recent asset sales, bolstering its liquidity. As a personal-finance decision, it's essential to consider the repercussions of potential market volatility and the company's overall financial health before investing in BIP's debt securities.